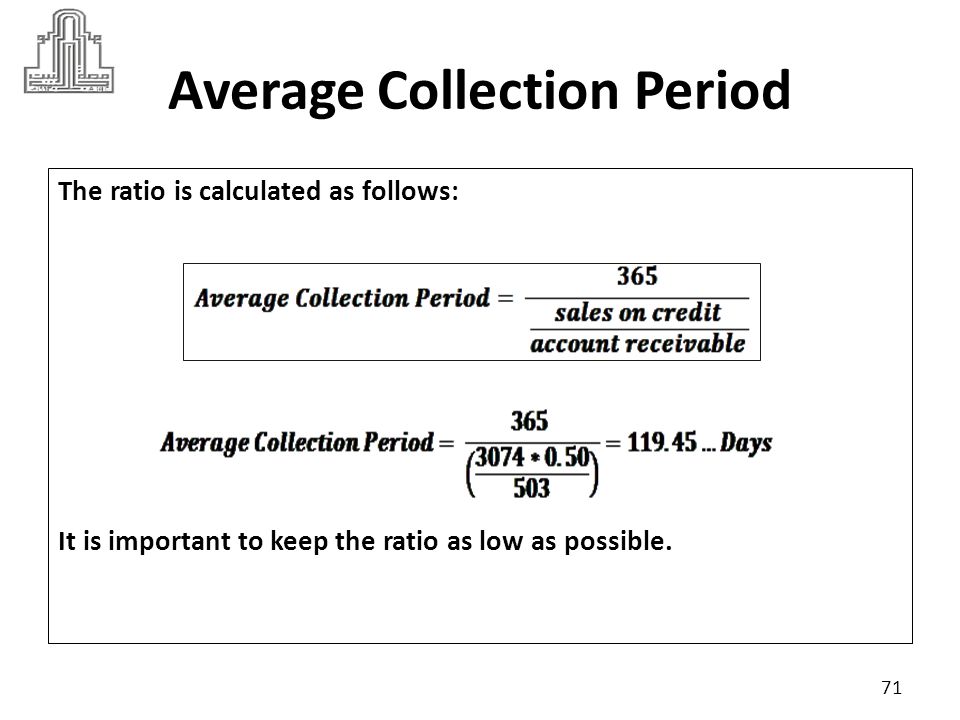

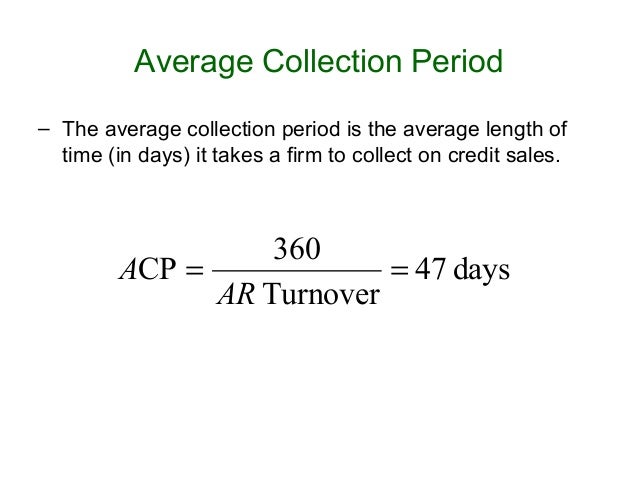

When customers pay their invoices quickly, companies can benefit from several advantages. ACP can be found by multiplying the days in your accounting period by your average accounts receivable balance. Then, divide the result by the net credit sales to find the average collection period. The average collection period refers to how long – in days – it takes for a company to collect on its accounts receivable. The receivables turnover value is the number of times that a company collects payments from customers per year. The average collection period is calculated by dividing total average accounts receivable balance by the net credit sales for a given period.

Communicate payment terms clearly

It can also offer pricing discounts for earlier payment (i.e. 2% discount if paid in 10 days). Companies may also compare the average collection period with the credit terms extended to customers. For example, an average collection period of 25 days isn’t as concerning if invoices are issued with a net 30 due date.

How is the Average Collection Period Formula Derived?

- It signifies the average number of days required for a company to collect its outstanding accounts receivables (AR).

- Striking the right balance between optimizing collections efficiency and maintaining strong relationships is crucial for long-term success.

- This includes any discounts awarded to customers, product recalls or returns, or items re-issued under warranty.

This includes any discounts awarded to customers, product recalls or returns, or items re-issued under warranty. To make it easier to send these polite reminders, QuickBooks allows you to create automated messages that you can send your clients. Calculating the average number of days it’ll take to get paid allows you to assess the effectiveness of your credit policy. Ultimately, this will help you make more informed financial decisions for your small business. On the other hand, if your results are better than average, you know you’re operating efficiently, and cash flow might be a competitive advantage.

Tips for Effective Use of an ACP Calculator

If you were to simply use your ending AR balance, your results might be skewed by a particularly large or small year-end balance. The current dollar amount of open invoices, based on days since the invoice date. In other words, Light Up Electric “turned over”—i.e., converted its AR into cash—21 times during the year. Upon dividing the receivables development rate by 365, we arrive at the same inferred collection ages for both 2020 and 2021 — attesting our previous computations were correct. This way, you’ll get more nuanced, actionable insights that can fuel business growth.

While the collection period formula is useful for measuring how efficiently you collect receivables, it has its limitations. In January, it took Light Up Electric almost seven days, on average, to collect outstanding receivables. This means Light Up Electric’s average collection period for the year is about 17 days. Although you can calculate it for a quarter, for most businesses it’s safer to look at a full year to compare fairly due to seasonality or accounts receivable booked in previous quarters. For example, if a company has an ACP of 50 days but issues invoices with a 60-day due date, then the ACP is reasonable. On the other hand, if the same company issues invoices with a 30-day due date, an ACP of 50 days would be considered very high.

Average Collection Period Calculator

The average collection period is closely related to the accounts turnover ratio, which is calculated by dividing total net sales by the average AR balance. First and foremost, establishing your business’s average collection period gives you insight into the liquidity of your accounts receivable assets. A decreasing average collection period is generally the trend companies like to see. Most of the time, this signals that the management has prioritized investment in collections and improved the collections processes.

That’s why it’s important not to take this metric at face value; be mindful of external factors that influence it. If you analyze a peak or slow month in isolation, your insights will be skewed, and you can’t make sound decisions based on those numbers. By benchmarking against the industry standard, a company can gauge easily whether the number is acceptable or if there is potential for improvement. For example, if a company has a collection period of 40 days, it should provide days. Since the company needs to decide how much credit term it should provide, it needs to know its collection period. The average collection period does not hold much value as a stand-alone figure.

This conversion process highlights how effectively a company manages its cash flows while minimizing its working capital requirements. Offer Financing OptionsOffering financing options to customers can encourage prompt payments while maintaining positive relationships. Providing flexible payment terms, such as installment plans or extended payment schedules, allows clients to manage their cash flows more effectively. Implement a Credit PolicyA well-structured credit policy can help manage customer risk and improve the overall collections process. Clearly define your credit terms, establish collection procedures, and outline consequences for late payments.

Late payments impact a company’s cash flow and can create strained communication between the parties involved. Additionally, extended payment terms may lead to customers feeling neglected or overlooked. The average inventory management definition collection period indicates the effectiveness of a firm’s accounts receivable management practices. It is very important for companies that heavily rely on their receivables when it comes to their cash flows.

A company’s performance is compared to its rivals using the average collection period, individually or collectively. The average collection times serve as a good comparison because similar organizations would have comparable financial indicators. Businesses can assess their average collection period concerning the credit terms provided to clients. If the invoices are issued with a net 30 due date, a collection period of 25 days might not be a cause for concern. Since it directly affects the company’s cash flows, it is imperative to monitor the outstanding collection period.