On average, dividend-paying stocks return 1.91% of the amount you invest in the form of dividends, which can provide a higher return than some high-yield savings accounts. Dividend stocks do not offer the same security of principal as savings accounts, though. Dividends are primarily paid to investors as cash, but some companies allow for the dividend payment to be reinvested as additional partial stock in the company. Dividends are primarily paid to investors as cash, but some companies allow the dividend payment to be reinvested as additional partial stock in the company. The money used to pay dividends comes directly from the income of a company.

What Is the Dividend Yield?

The United States is alone in this sense among industrialized countries- it taxes the money you make overseas even if you already paid income tax there. The primary reason dividend stocks can keep giving returns during recessions is that consumers have a list of necessities they are willing to cut back on last. These include items like utilities, gas, groceries, and phone service, all sectors with excellent yields.

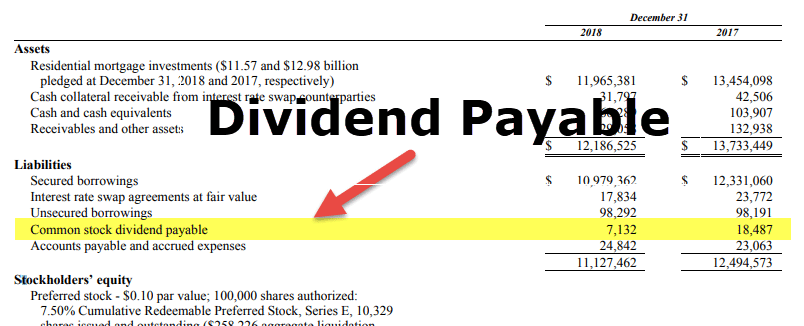

Where Are Dividends Found on a Balance Sheet?

Dividends are generally subject to taxation, but the specific tax treatment can vary depending on the type of dividend and the jurisdiction in which the shareholder resides. For instance, in the United States, qualified dividends are taxed at the capital gains tax rate, which is typically lower than the ordinary income tax rate. This preferential tax treatment is designed to encourage investment in corporate equities. However, not all dividends qualify for this lower rate; non-qualified dividends are taxed at the higher ordinary income tax rates, which can significantly impact an investor’s after-tax income.

Tax Implications of Dividend Payments

Understanding how dividends are accounted for is essential for both investors and financial professionals, as it impacts the overall financial health and reporting of an organization. Some may choose to hang onto the funds and reinvest them in dividend account type the company, particularly if the company is less established or focused on expanding. It’s also common for companies to suspend dividends if they’re experiencing some sort of financial trouble like a dip in revenue or an expensive lawsuit.

- A company’s dividend sustainably is of paramount importance to investors.

- This occurrence is rare in smaller businesses or businesses that are investing in rapid growth, but common in corporations with good cash flow that have reached a titanic size, such as Walmart.

- The fair value of the additional shares issued is based on their fair market value when the dividend is declared.

- In some jurisdictions, tax credits or deductions are available to mitigate the impact of double taxation.

Different Types of Dividend Payments

This strategy can appeal to investors who are more interested in potential future gains rather than immediate income. The choice between these approaches often hinges on the company’s stage in its lifecycle, industry norms, and competitive landscape. However, dividends are more likely to be paid by well-established companies that no longer need to reinvest as much money back into their business.

Accounting for Dividends: Journal Entries and Financial Impact

A dividend is when a company periodically gives its shareholders a payment in cash, additional shares of stock, or property. The size of that dividend payment depends on the company’s dividend yield and how many shares you own. Dividends can take various forms, each with distinct accounting treatments.

In some jurisdictions, tax credits or deductions are available to mitigate the impact of double taxation. For example, in Canada, the dividend tax credit allows individuals to reduce their tax liability on dividends received from Canadian corporations. This credit is designed to account for the corporate taxes already paid on the distributed profits, thereby reducing the overall tax burden on shareholders. Such mechanisms can significantly influence investor behavior and the attractiveness of dividend-paying stocks.

So not only would you be paying a more significant fee, but your portfolio would also underperform by 1.3%. According to the research, low-cost mutual funds outperformed higher-cost counterparts by approximately 1.3 percent. Most investment books do not discuss this topic extensively, but it is crucial to understanding the market. With a global economy, it becomes increasingly important to understand the currency we will be paid in and whether that currency will appreciate or depreciate over time.

REITs offer an average dividend yield of 3.8%, more than double what you might get from an S&P 500 fund. REITs focusing on certain sectors, like mortgages, may even offer higher yields. Special dividends might be one-off payouts from a company that doesn’t normally offer dividends, or they could be extra dividends in addition to a company’s regularly scheduled dividends. Quarterly is the most common frequency of payment, but a company can also choose to pay monthly, semi-annually, or annually. Dividends can alternatively be “special,” meaning that they are a one-time payment that won’t repeat (or won’t repeat at the same amount), but more often dividends are paid on a schedule.

A real estate investment trust (REIT) owns or operates income-producing real estate. To be classified as a REIT, 90% of the taxable income these companies earn each year must be paid out in the form of dividends, and 20% of those dividends must be paid as cash. You can sell these dividend shares for an immediate payoff, or you can hold them.

This is done by debiting the Dividends Payable account and crediting the Cash account. This entry effectively reduces the company’s cash balance, as the funds are transferred to the shareholders, and eliminates the liability that was previously recorded. Regular dividend payments should not be misread as a stellar performance by the fund. A high-value dividend declaration can indicate that a company is doing well and has generated good profits. But some may interpret it as an indication that the company does not have much going in the way of new projects to generate better returns in the future.