There are several ways to thrive in this industry, so we put together this list of the five best weekend accounting and tax jobs you can do to boost your income. Virtual bookkeepers use specialized accounting software like QuickBooks, Xero, or FreshBooks to record and track financial data. Most small-business accounting programs offer free trials, though opting for a free trial usually means waiving any discounts you would otherwise lock in. If you’ve never used accounting software before (and even if you have), we encourage you to check out as many free trials as possible. Eventually, you’ll find an accounting program with the interface, features, integrations and plans you need.

If you’re organized and enjoy working with numbers, a job as a bookkeeper could be a good fit. I’m still here to assist you further with managing your fixed assets, running reports, and more. I’m still all ears if you need further assistance managing your fixed assets, running reports, etc.

Earn a career certificate

In the retained earnings account, bookkeepers monitor any profit the company makes that isn’t paid out to owners and investors. It’s important to keep payroll expenses accurate and updated to ensure the business meets legal requirements. Bookkeepers track the materials and goods purchased for the business in the purchases account. You use this to calculate the COGS, and you subtract it from sales to determine the company’s gross profit. Revenue refers to all the income that comes into the business after selling products and services.

No other posts published in the last 5 days.

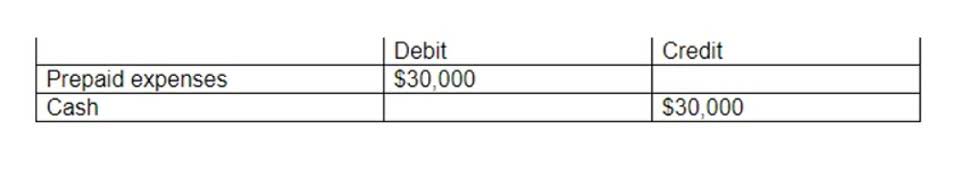

Your business’s books are balanced when all of the debits equal (or cancel out) all of the credits. And since it takes equity, assets and liabilities — on top of expenses and income — into account, it typically gives you a more accurate financial snapshot of how to learn bookkeeping your business. Single-entry accounting records all of your transactions once, either as an expense or as income. This method is straightforward and suitable for smaller businesses that don’t have significant inventory or equipment involved in their finances.

Handle accounts receivable and payable

Did you know that you can learn how to become a bookkeeper in less than one year with no experience? This makes bookkeeping a popular choice for those without degrees or those ready for a career change. Students interested in launching careers in business, finance, accounting and management benefit from this course. Completing bookkeeping courses online can also increase your competitive standing in the job market.

If you’re using the wrong credit or debit card, it could be costing you serious money. Our experts love this top pick, which features a 0% intro APR for 15 months, an insane cash back rate of up to 5%, and all somehow for no annual fee. If you opt to not link your software with your bank, you will need to reconcile you accounts manually. Whichever way you do it, it’s important to complete the process on a regular basis. For example, if you prepare and post an invoice in the amount of $150 to John Brown for consulting, you’ll need to record that information in a journal entry. This process can be as simple as preparing an invoice for a customer to setting up your electric bill to be paid.

Why people choose Coursera for their career

Accruals will consist of taxes owed including sales tax owed and federal, state, social security, and Medicare tax on the employees which are generally paid quarterly. Long-term liabilities have a maturity of greater than one year and include items like mortgage loans. Assets are what the company owns such as its inventory and accounts receivables. Assets also include fixed assets which are generally the plant, equipment, and land. If you look you look at the format of a balance sheet, you will see the asset accounts listed in the order of their liquidity. Asset accounts start with the cash account since cash is perfectly liquid.

- The income statement is developed by using revenue from sales and other sources, expenses, and costs.

- Expenses refer to the money used to run the business but aren’t related to products or services.

- However, completing a bookkeeping certification program can teach you basic accounting and how to perform bookkeeping tasks and has the potential to set you apart from other bookkeepers.

- While FreshBooks has a lower starting price than most other paid accounting software services, it also charges more for additional users than its top competitors.

- If you only want to read and view the course content, you can audit the course for free.