Elder User

According to equilibrium of your first mortgage you will need to adopt doing some brand of construction mortgage. Whether it is either a short-title refi or a home collateral loan. The new appraiser you can expect to the fresh ready loan places Berlin yourself a keen as well as and you may a keen because the over valuation. When the work is accomplished you have made a different appraisal and you will re-finance. Unless you are carrying out a housing mortgage which have periodic inspections and you may brings I doubt there was a loan provider that will simply give you the dollars. The only way you could get a lump sum of cash depends in your property introduce value along with your guarantee.

Probably would get the best chance working with a community financial otherwise borrowing partnership. The big on line mortgage organizations such as for example Quicken and you will Credit Tree is significantly more on the turning and you can burning. Their agencies try accredited situated so that they have a tendency to force difficult to score a package closed even if it might not be exactly what the consumer means otherwise desires.

Elder Representative

Extremely appraisals having home loan financing try finished “as is” and are generally attending look at the property whilst currently is actually. This type of appraisals was seemingly cheaper, this could make sense to just let them inform you if you have security to pay for cash-out you search. If you think that sprucing it will return more the purchase price, then go for it. It may sound as you are likely to renovation a short while later anyway so maybe doing it double is not best value.

I might generally counsel people considered ample home improvements to adopt a great renovation/rehabilitation mortgage, very first cause would be the fact it allows one set a budget to each other, package, after which will get an impression of value that allow you to know if your own home improvements will likely return value into the possessions and you may enables you to determine whether that is convenient as to what you are paying after a while and perform. Sometimes someone determine it is better or better to just promote and you can go on to a location that meets their demands. But that’s your own choice and you may planning for a rehabilitation loan assists you to make an informed choice.

If you learn you never have enough guarantee, your most likely wanted the assessment so you can echo the matter/updates/home improvements of the home once it would be complete. This really is basically also known as a restoration loan otherwise rehab financing and need to have a listing of renovations you propose to manage with contractor estimates, if you don’t agent/systems documents.

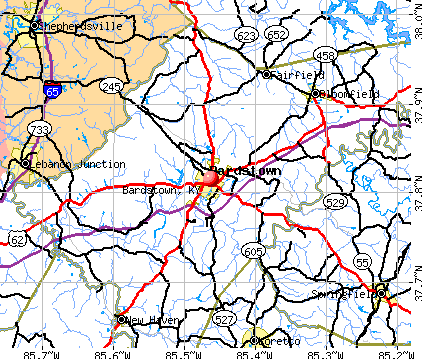

I am from inside the Ohio and also complete an effective 203k streamline FHA financed renovation in order to a home here. There have been two common res utilized in Ohio. In the most common section, you might go into the 300’s having an enthusiastic FHA rehabilitation loan or 400’s which have an effective homestyle conventional non-jumbo renovation financing. There might be others as well, however these will be the most common.

One another FHA and you may Federal national mortgage association have other sites that guide you in order to lenders who do these financing. I would personally and additionally recommend coping with the tiny in order to mid sized lead loan providers as the assistance away from high loan providers are now and again difficult of these financing systems.

Inside the additional so you can advantages from lending, you can find applications to aid resident purchase home improvements or rescue money on fees. Around and taxation loans, in your community financed gives, and less res using local government. Those people are going to trust your location found and what you’re seeking to do. Both these may become fantastic, make an effort to perform some research about what can be acquired otherwise hire a bona-fide house expert in order to give you advice.