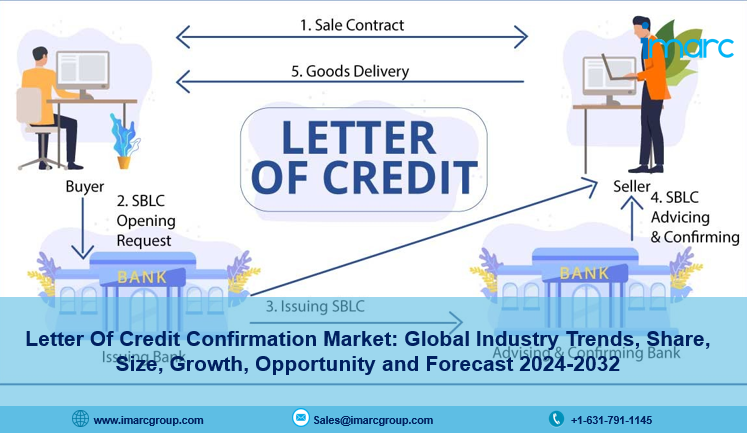

IMARC Group’s report titled “Letter of Credit Confirmation Market Report by L/C Type (Sight L/C, Usance L/C), End User (Small-sized Businesses, Medium-sized Businesses, Large Enterprises), and Region 2024-2032“. The global letter of credit confirmation market size reached US$ 4.5 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 6.2 Billion by 2032, exhibiting a growth rate (CAGR) of 3.48% during 2024-2032.

For an in-depth analysis, you can refer sample copy of the report: https://www.imarcgroup.com/letter-of-credit-confirmation-market/requestsample

Factors Affecting the Growth of the Letter of Credit Confirmation Industry:

- Risk Mitigation in International Transactions:

The increasing need for risk mitigation in international trade represents one of the key factors supporting the market growth. When engaging in cross-border transactions, businesses face various risks, including credit risk, political risk, and currency fluctuation risks. The letter of credit (LC) confirmation provides an extra layer of security, assuring sellers that payment will be secured even if the buyer or the country of the buyer faces economic or political challenges. The increasing awareness and aversion to these risks among international traders is resulting in a greater reliance on LCs as a risk management tool.

- Technological Advancements:

The increasing integration of technology in financial services is contributing to the market growth. Advancements in fintech, blockchain, and digitalization of banking processes are streamlining and securing LC transactions. Technologies like blockchain offer enhanced transparency, reduced risk of fraud, and faster processing times for LCs, making them more attractive to both buyers and sellers in international trade. The growing implementation of electronic letters of credit (eLCs) for reducing paperwork, cutting down on errors, and speeding up transaction times is offering a favorable market outlook. The continuous enhancement in technology is making LC transactions more efficient and accessible.

- Increasing Focus on Supply Chain Efficiency:

The rising emphasis on supply chain efficiency and optimization in international trade is strengthening the growth of the market. Companies are seeking ways to reduce delays, minimize errors, and optimize working capital. LCs play a crucial role in achieving these goals by providing a reliable and efficient mechanism for payment and reducing the risk of supply chain disruptions. The certainty and speed offered by LCs, especially when coupled with digital platforms, align with the broader business objective of supply chain efficiency. There is an increase in demand for LCs, particularly those facilitated by technology, as more companies prioritize streamlined and efficient supply chains.

Leading Companies Operating in the Global Letter of Credit Confirmation Industry:

- Citigroup Inc.

- DBS Bank Ltd.

- JPMorgan Chase & Co

- Mizuho Bank Ltd.

- Standard Chartered plc

- Sumitomo Mitsui Banking Corporation

- The Bank of Nova Scotia

- The PNC Financial Services Group Inc.

Ask Analyst for Sample Report: https://www.imarcgroup.com/request?type=report&id=6461&flag=C

Letter of Credit Confirmation Market Report Segmentation:

By L/C Type:

- Sight L/C

- Usance L/C

Sight L/C exhibits a clear dominance in the market as it provides immediate payment upon presentation of documents.

By End User:

- Small-sized Businesses

- Medium-sized Businesses

- Large Enterprises

Large enterprises hold the biggest market share, which can be attributed to the increase in international trade, necessitating the use of letters of credit (LC) to mitigate risks in high-value transactions.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific dominates the market owing to the high volume of trade activities, which heavily relies on LC for import and export transactions.

Global Letter of Credit Confirmation Market Trends:

The growing trend of the diversification of trade finance products, with a particular focus on customized and flexible solutions is positively influencing the market. Financial institutions and fintech companies are innovating LC solutions to offer products that cater to specific needs and scenarios of international trade. This includes the development of specialized LCs for different types of goods, services, and industries, as well as LCs that can accommodate various transaction structures and terms.

Besides this, the rising regulatory compliance and risk management are driving the demand for LC confirmations as they provide an additional layer of security and compliance assurance. This compliance focus ensures that LCs are not only facilitating trade but also adhering to stringent international financial laws, thereby reducing the risk of financial fraud and enhancing the trust in these instruments.

Note: If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARCs information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145 | United Kingdom: +44-753-713-2163