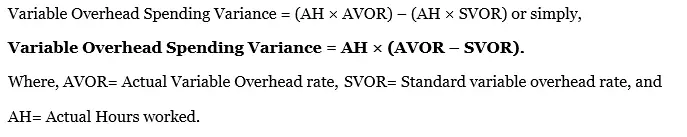

Thevariable overhead efficiency variance is the differencebetween the actual activity level in the allocation base (oftendirect labor hours or machine hours) and the budgeted activitylevel in the allocation base according to the standards. The two variances used to analyze this difference are thespending variance and efficiency variance. Thevariable overhead spending variance18is the difference between actual costs for variable overhead andbudgeted costs based on the standards.

What are the causes of an overhead variance?

In this example, the variable overhead rate variance is positive (favorable), as the actual variable overhead rate (4.783) is lower than the standard rate (5.00), and therefore the business paid less for the variable overhead than it expected to. how long does an irs tax audit take This variance would be posted as a credit to the variable overhead rate variance account. To determine the overhead standard cost, companies prepare a flexible budget that gives estimated revenues and costs at varying levels of production.

8 Overhead Variances

- This type of variance is calculated separately for direct variable expenses and overhead variable expenses.

- Variable Overhead Efficiency Variance is the measure of impact on the standard variable overheads due to the difference between standard number of manufacturing hours and the actual hours worked during the period.

- Connie’s Candy used fewer direct labor hours and less variable overhead to produce \(1,000\) candy boxes (units).

- Remember that both the cost and efficiency variances, in this case, were negative showing that we were under budget, making the variance favorable.

- In this example, the variable overhead rate variance is positive (50 favorable), and the variable overhead efficiency variance is also positive (100 favorable), resulting in an overall positive variable overhead variance (150 favorable).

The variable overhead variance is a measure of the difference between the standard variable overhead costs and the actual variable overhead costs incurred for a given period. Furthermore in a standard costing accounting system, variable overhead has two main variances, the variable overhead rate variance and the variable overhead efficiency variance. The variable overhead efficiency variance is the difference between the actual and budgeted hours worked, which are then applied to the standard variable overhead rate per hour. A favorable variance means that the actual hours worked were less than the budgeted hours, resulting in the application of the standard overhead rate across fewer hours, resulting in less expense being incurred. However, a favorable variance does not necessarily mean that a company has incurred less actual overhead, it simply means that there was an improvement in the allocation base that was used to apply overhead.

Financial and Managerial Accounting

If Connie’s Candy only produced at \(90\%\) capacity, for example, they should expect total overhead to be \(\$9,600\) and a standard overhead rate of \(\$5.33\) (rounded). If Connie’s Candy produced \(2,200\) units, they should expect total overhead to be \(\$10,400\) and a standard overhead rate of \(\$4.73\) (rounded). Standard costs are used to establish theflexible budget for variable manufacturing overhead. The flexiblebudget is compared to actual costs, and the difference is shown inthe form of two variances. The variable overhead spendingvariance represents the difference between actual costs forvariable overhead and budgeted costs based on the standards.

Understanding Variable Overhead Spending Variance

The other variance computes whether or not actual production was above or below the expected production level. Connie’s Candy used fewer direct labor hours and less variable overhead to produce \(1,000\) candy boxes (units). Favorable variable overhead efficiency variance indicates that fewer manufacturing hours were expended during the period than the standard hours required for the level of actual output. The fixed factory overhead variance represents the difference between the actual fixed overhead and the applied fixed overhead. Connie’s Candy used fewer direct labor hours and less variable overhead to produce 1,000 candy boxes (units).

Overhead Variances

The standard overhead rate is the total budgeted overhead of $10,000 divided by the level of activity (direct labor hours) of 2,000 hours. Notice that fixed overhead remains constant at each of the production levels, but variable overhead changes based on unit output. If Connie’s Candy only produced at 90% capacity, for example, they should expect total overhead to be $9,600 and a standard overhead rate of $5.33 (rounded). If Connie’s Candy produced 2,200 units, they should expect total overhead to be $10,400 and a standard overhead rate of $4.73 (rounded). In addition to the total standard overhead rate, Connie’s Candy will want to know the variable overhead rates at each activity level. The standard overhead rate is the total budgeted overhead of \(\$10,000\) divided by the level of activity (direct labor hours) of \(2,000\) hours.

Additionally the method of allocation is more fully discussed in our applied overhead tutorial. Recall that the standard cost of a product includes not only materials and labor but also variable and fixed overhead. It is likely that the amounts determined for standard overhead costs will differ from what actually occurs. Consequently this variance would be posted as a credit to the variable overhead efficiency variance account. Again, this analysis is appropriate assuming direct labor hourstruly drives the use of variable overhead activities.

Specifically, fixed overhead variance is defined as the difference between Standard Cost and fixed overhead allowed for the actual output achieved and the actual fixed overhead cost incurred. Budget or spending variance is the difference between the budget and the actual cost for the actual hours of operation. This variance can be compared to the price and quantity variance developed for direct materials and direct labor.

That is, weassume that an increase in direct labor hours will increasevariable overhead costs and that a decrease in direct labor hourswill decrease variable overhead costs. As the name suggests, variable overhead efficiency variance measure the efficiency of production department in converting inputs to outputs. Variable overhead efficiency variance is positive when standard hours allowed exceed actual hours. Therefore a positive value is favorable implying that production process was carried out efficiently with minimal loss of resources. Variable Overhead Efficiency Variance is traditionally calculated on the assumption that the overheads could be expected to vary in proportion to the number of manufacturing hours. Using Activity based costing in the calculation of variable overhead variances might therefore provide more relevant information for management control purposes.

This formula takes the difference between the standard quantity and the actual quantity of variable overhead allocated, and multiplies this by the standard variable overhead rate. To operate a standard costing system and allocate variable overhead, the business must first decide on the basis of allocation. Various methods can be used to allocate the variable overhead including for example, the number of direct labor hours used in production or the number of machine hours used.