It is used to evaluate pricing strategies, optimize production and make informed decisions about inventory management and paints a picture of your production efficiency. Although the formula may seem straightforward, accurately capturing sales and matching them with their corresponding costs can be intensive. As you introduce new products to the market, this effort only grows more demanding and complex. Inventory represents a significant part of the balance sheet for many companies. In accounting for inventory determining and capturing the costs to be recognized as an asset through the inventory lifecycle is key, because it affects a company’s KPIs such as gross profit margin. Despite similar objectives, IAS 21 differs from ASC 330 in a number of areas2.

What are the most common inventory accounting methods?

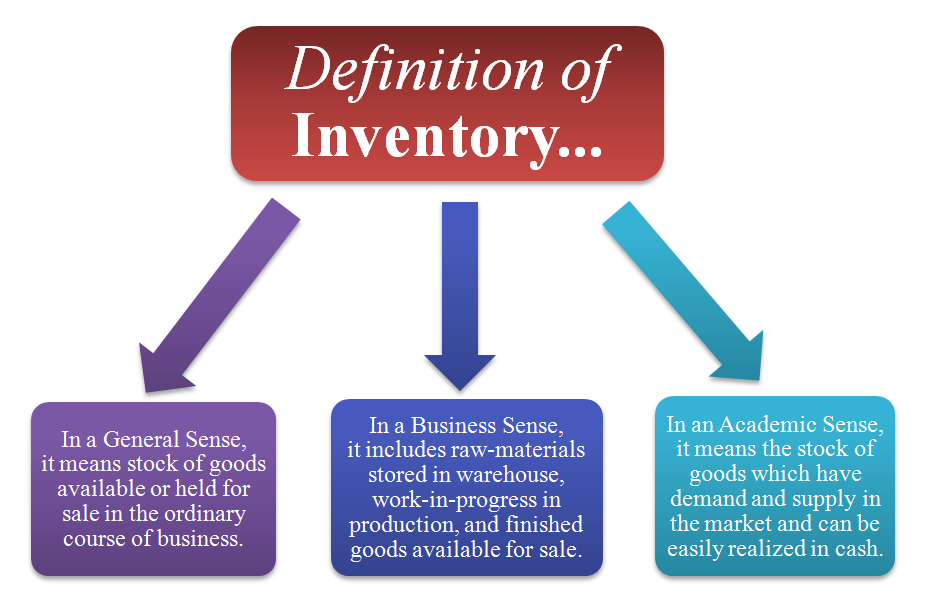

Choosing the right method is crucial for accurate financial reporting and decision-making. In other words, these goods and materials serve no other purpose in the business except to be sold to customers for a profit. The sole purpose of these current assets 3 golden rules of accounting rules to follow examples and more is to sell them to customers for a profit, but just because an asset is for sale doesn’t mean that it’s considered inventory. We need to look at three main characteristics of inventory to determine whether an asset should be accounted for as merchandise.

What are costing techniques?

Therefore, your CoGS helps you to figure out the amount of gross profit you’ve made in a sale. So for example if you sell an item that is valued at £100, and the CoGS is £70, then you’ve achieved a gross profit of £30. The GAAP rules also guard against company’s potentially overstating their value. Since inventory is an asset, it actually affects the overall valuation of the business.

Other Post You May Be Interested In

- loving-joy-real-feel-pussy-stroker

- Типы мобильных приложений

- Advertising Through Seo – Rising Over The Ranks

- Популяризация интернет-площадки статьями

- Lumina Grand Showflat Tour: Discover What Luxury Really Means

- How to Secure Your Spot in Singapore’s Most Coveted EC: Lumina Grand

- How To Reap Profits In Real Estate Investing Near Maheshwaram

- Exploring The Latest Trends In Press Brake Die Manufacturing

- Breaking into the Mortgage Industry: Insider Secrets You Need to Know

- The Future Of Vaping: Cutting-Edge Technologies And Designs

Comprehensive Guide to Inventory Accounting Practices and Principles

When a business sells inventory at a faster rate than its competitors, it incurs lower holding costs and decreased opportunity costs. As a result, they often outperform, since this helps with the efficiency of its sale of goods. GAAP mandates the lower of cost or market value method to prevent companies from overstating their assets. Improving DIO involves better demand forecasting, supply chain optimization, and strategies like just-in-time inventory management. So in theory, it should be an asset, but it gets converted to cans of beer and sold over time.

Choosing the right inventory accounting method for your business

The benefit to the supplier is that their product is promoted by the customer and readily accessible to end users. The benefit to the customer is that they do not expend capital until it becomes profitable to them. This means they only purchase it when the end user purchases it from them or until they consume the inventory for their operations. It is important to recognize that GAAP is not a stagnant set of principles. Rather, it changes to reflect changes in regulations and standards employed by businesses operating in different industries throughout the economy as a whole. Changes are made regularly to what is, and what is not, a generally accepted principle of accounting.

- For instance, a company runs the risk of market share erosion and losing profit from potential sales.

- Effective finished goods inventory management helps your business meet customer demand, reduce storage costs, and direct supply chain efforts without too many hurdles.

- The other item the GAAP rules guard against is the potential for a company to overstate its value by overstating the value of inventory.

How to manage and reduce inventory costsArrow right

Accurately valuing inventory is crucial for financial reporting and decision-making. It involves determining the cost of inventory, including direct costs such as materials and labor, as well as indirect costs like overhead expenses. The value of inventory can fluctuate based on market conditions, obsolescence, and other factors.

There are three main methods of inventory valuation that companies can use to account for the value of their stock. To accurately calculate and record the valued inventory each year, businesses must select one of these costing methods and apply it consistently. It is defined as the array of goods used in production or finished goods held by a company during its normal course of business. I am trying to enter the cost per can so it can be reflected on our balance sheet and accurately reflect the inventory assets that we have on hand. However, when I enter the cost per can, it shows up on our balance sheet, but also on our P&L as COGS.

Integrating inventory management systems with accounting software ensures seamless flow of data between inventory and financial records. This integration eliminates the need for manual data entry, reduces errors, and provides real-time visibility into inventory costs, sales, and profitability. By centralizing data, businesses can make informed decisions and streamline their inventory accounting processes. Inventory accounting is the process of accurately valuing and recording a company’s inventory assets. It is essential for maintaining proper financial records and complying with accounting standards. Inventory includes raw materials, work in progress, and finished goods held by a company.

Unloop is the first and only accounting firm exclusively servicing ecommerce and inventory businesses in the US and Canada. With the power of people and technology, our team dives deep into COGS and inventory accounting. You are paired with a dedicated bookkeeping team that prepares accurate financial statements, financial forecasts, and can also pay bills or run payroll for you. Come tax time, everything is organized and ready to go, so you don’t need to worry.