Sometimes, an accounting transaction affects the accounts of the same element. Similarly, when a business earns revenue, it affects not only the income but also the assets and equity of the business. It is because annual reports of publicly traded companies must contain audited financial statements formed using double-entry booking.

Role of the trial balance in verifying the accuracy of recorded transactions

By studying these historical cases, businesses and accounting professionals can internalize the critical role of transparency, ethics, and accuracy in financial reporting. Applying the lessons learned safeguards against accounting errors that could lead to devastating consequences. Accounting stands as the backbone of every business and financial activity, serving as the language of commerce that enables organizations to convey their financial health, performance, and prospects.

Can the dual aspect concept of accounting theory be applied to all enterprises?

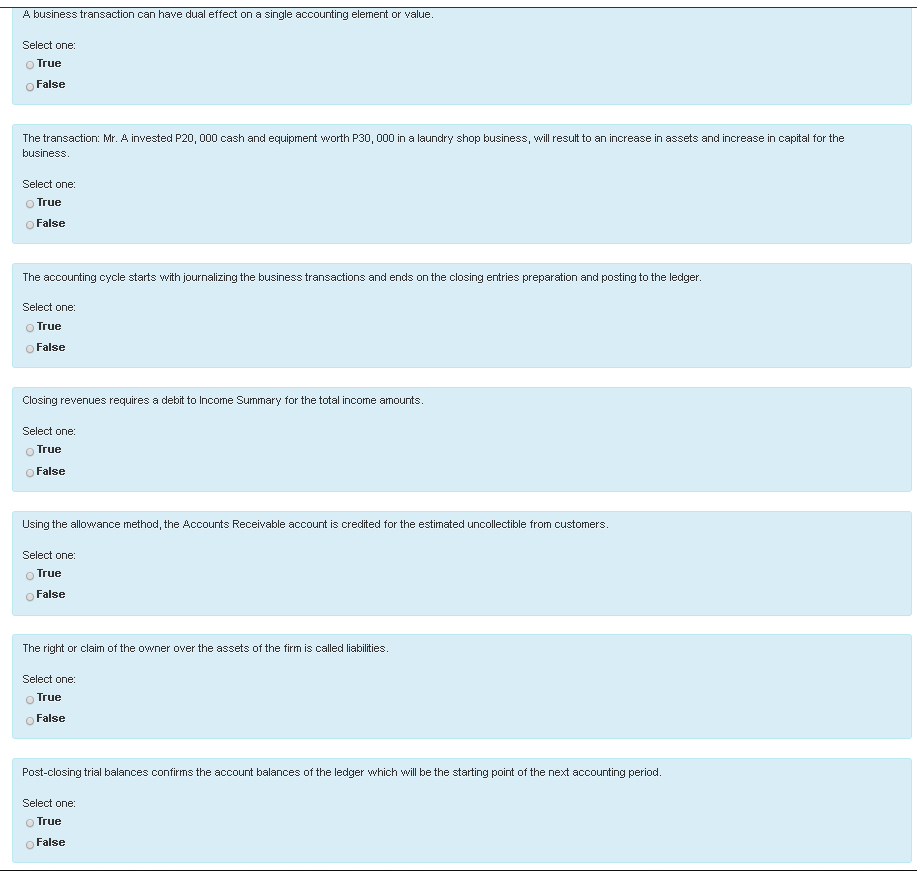

The classification of debit and credit effects is structured in such a way that for each debit there is a corresponding credit and vice versa. Hence, every transaction will have ‘dual’ effects (i.e. debit effects and credit effects). Double-entry accounting prohibits recording the sole impact of a transaction in the absence of another effect somewhere in the accounting books. In such a case, one asset account is increased (cash/bank) while another asset account is reduced (receivable), leaving the overall amount of assets unchanged. The accounting system has since evolved to account for the dual nature of business transactions, which we explore in the next section.

Ask a Financial Professional Any Question

- However, it will be difficult to determine the balances of other accounts such as revenues and expenses unless the company maintains separate books for them as well.

- This fact applies to all the transactions that a business may enter into at any stage of its existence.

- Let us understand the different bookkeeping forms to see why the dual aspect concept is the most widely accepted norm for auditing purposes.

The subsequent investigation revealed that the company had inflated its profits by nearly $4 billion. The Enron scandal was a high-profile corporate fraud and accounting scandal that shook the business world in the early 2000s. Enron Corporation, once considered one of the most innovative companies in the United States, used complex accounting practices to manipulate financial statements and hide massive debts, thereby inflating its reported profits. If the bakery’s purchase was made with cash, a credit would be made to cash and a debit to asset, still resulting in a balance. This practice ensures that the accounting equation always remains balanced; that is, the left side value of the equation will always match the right side value.

In the realm of accounting, the double-entry bookkeeping system is a fundamental concept that ensures accurate and reliable financial records. At its core, this system is based on the dual aspect concept, which states that every transaction has two aspects – a debit and a credit. These aspects are recorded in separate accounts do i need a tax id number for my business known as assets and liabilities. Understanding the role of assets and liabilities in double-entry bookkeeping is crucial for maintaining the integrity of financial statements and making informed business decisions. T-Accounts play a vital role in error detection and maintaining the equilibrium in double entry accounting.

As the lifeblood of informed decision-making, accurately recorded transactions are a critical component in the foundation of successful business operations. The hydroboration of alkynes into vinylboronate esters is a vital transformation, but achieving high chemoselectivity of targeted functional groups and an appreciable turnover number is a considerable challenge. Herein, we develop two dynamically regulating dual-catalytic-site copper clusters (Cu4NC and Cu8NC) bearing N-heterocyclic thione ligands that endow Cu4NC and Cu8NC catalysts with performance. In particular, the performance of microcrystalline Cu4NC in hydroboration is characterized by a high turnover number (77786), a high chemoselectivity, high recovery and reusability under mild conditions. Mechanistic studies and density functional theory calculations reveal that, compared with the Cu8NC catalyst, the Cu4NC catalyst has a lower activation energy for hydroboration, accounting for its high catalytic activity.

Give your skills a boost with Intuit Academy Bookkeeping Professional Certificate. You’ll learn bookkeeping basics like double-entry accounting, along with accounting for assets and financial statement analysis. With courses like these under your belt, you’re well on your way to becoming a successful accountant. Many companies, regardless of their size or industry, use double-entry accounting for their bookkeeping needs because it provides a more accurate depiction of their financial health. This bookkeeping method also complies with the US generally accepted accounting principles (GAAP), the official practice and rules for double-entry accounting.

The system’s advantages include enhanced accuracy and easier identification of errors in financial records. The dual aspect account concept is required for formal audits and publicly traded companies. This simply records a list of credits and debits to a single account, rather than showing a balance sheet with all assets, liabilities, and equity. It’s also possible to find multi-entry accounts when greater transactional complexity is involved, though this can be time-consuming. The income statement portrays the impact of various transactions on the company’s revenue and expenses.