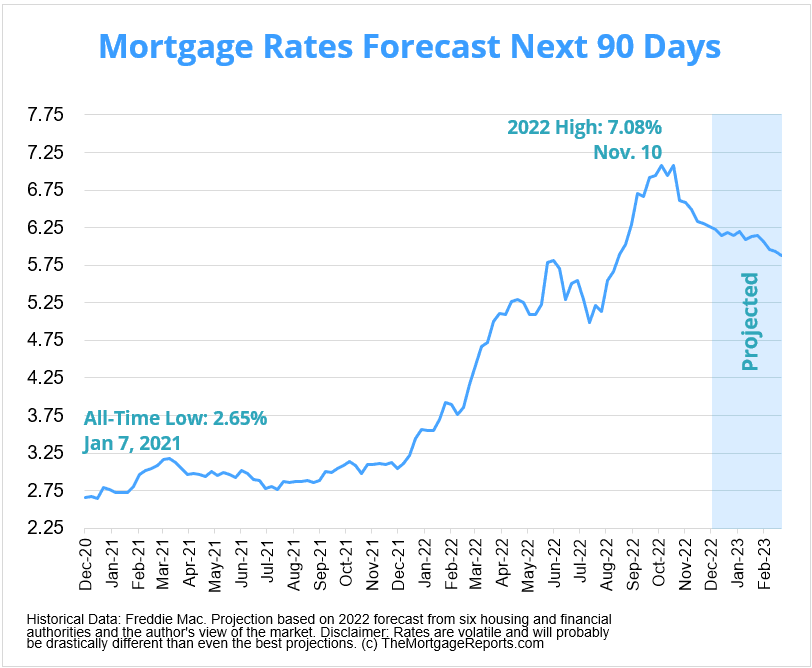

But not, guess rather that the creditor consummates a top-charged home mortgage during the 2017 based on a credit card applicatoin obtained when you look at the

35(b)(2) Exemptions

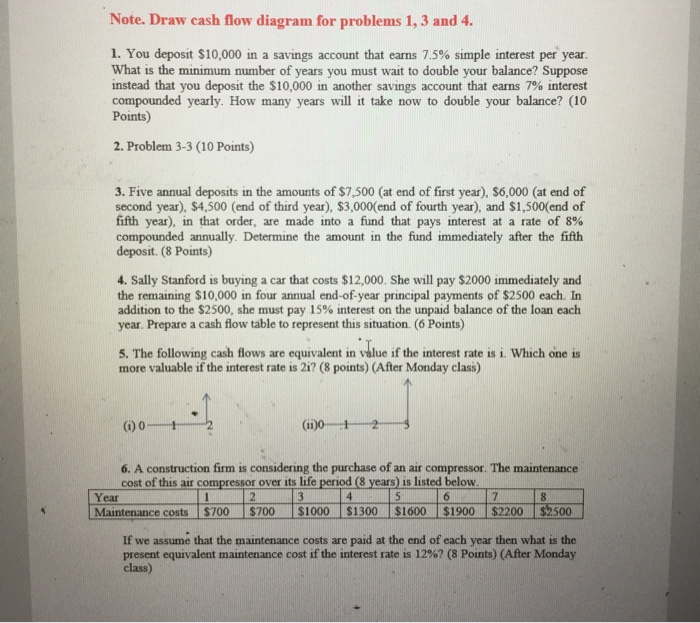

step 1. Criteria to possess different. Less than (b)(2)(iii), but since provided from inside the (b)(2)(v), a collector does not have to establish an escrow take into account taxation and you may insurance getting a high-cost real estate loan, provided the following four requirements was came across when the high-cost mortgage is consummated: