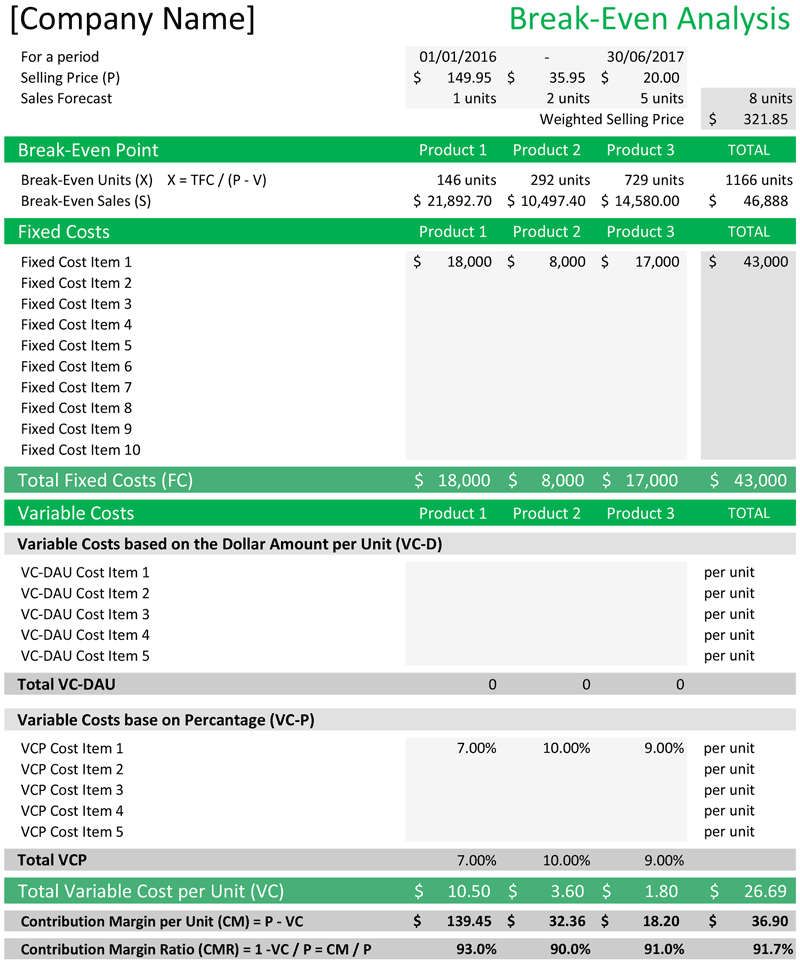

Once you calculate your break-even point, you can determine how many products you need to manufacture and sell to make your business profitable. Barbara is the managerial accountant in charge of a large furniture factory’s production lines and supply chains. Alternatively, the break-even point can also be calculated by dividing the fixed costs by the contribution margin.

- It’s one of the biggest questions you need to answer when you’re starting a business.

- If you are a house painter, and your average price for painting a house is $7,000, a break-even analysis will calculate how many homes you must paint each month to cover your costs.

- For many businesses, the answer to both of these questions is yes.

- Variable costs are calculated on a per-unit basis, so if you produce or sell more units, the variable cost will increase.

- The break-even point is the volume of activity at which a company’s total revenue equals the sum of all variable and fixed costs.

- Analyzing break even points provide entrepreneurs with insight into how to manage their company’s production, operations, sales, and even loan repayment strategies.

Join Local Business Organizations

We use the formulas for number of units, revenue, margin, and markup in our break-even calculator which conveniently computes them for you. The latter is a similar calculation, but it’s based around knowing how much you bring in over a certain period of time. It might be a good idea to come back to this break-even calculator after you actually start doing business. Often times you will find the need to adjust your costs and factor in things you overlooked before. Depending on your needs, you may need to calculate your profit margin or markup to find your revenue… This will allow you to calculate the maximum price you may pay for goods, given all of your other numbers.

Factors used in break-even analysis

For example, if you run a café, you might decide to lower the price of your best-selling drink to attract more customers. While this could boost foot traffic, it also means your break-even point will change and you’ll need to sell more drinks to reach profitability. Now Barbara can go back to the board and say that the company must sell at least 2,500 units or the equivalent of $1,250,000 in sales before any profits are realized. The total variable costs will therefore be equal to the variable cost per unit of $10.00 multiplied by the number of units sold. One business’s fixed costs could be another business’s variable cost. If your company has an accountant under a monthly retainer, your analysis should consider the retainer fee as a fixed cost.

Free Business Calculators

Depending on your market, it might not be a competitive price that entices sales. Once you know this, you can adjust your loan repayment to a three-year period instead. This way, you can keep the selling price more reasonable while still paying off your commercial loan. Ready to find out how many units you need to sell to cover your costs? Enter your values above and calculate your break-even point now.

On the downside, business lines of credit come with smaller limits, which range from $1,000 to $250,000. And because the limit is low, these are usually unsecured loans. Moreover, you don’t need any collateral such as real estate to secure financing. But note that some lenders may require you to put a personal guarantee or lien on your business assets.

Analyzing break even points provide entrepreneurs with insight into how to manage their company’s production, operations, sales, and even loan repayment strategies. It’s a good idea to calculate your break-even point periodically, especially when there are changes in costs or pricing. Yes, the break-even point can change if your fixed or variable costs change, or if you change your pricing strategy. It’s important to recalculate BEP when any major shifts occur in your business. If you won’t be able to reach the break-even point based on your current price, you may want to increase it.

We have four types of online calculators with more functionalities for those who are part of the PM Calculators membership. The break-even point is crucial for businesses to ensure that they are not operating at a loss. It helps you understand how much money you need to make before you start generating profits, allowing for more effective financial advance rent: definition journal entry accounting treatment example planning. The break-even point is the number of units that you must sell in order to make a profit of zero. You can use this calculator to determine the number of units required to break even. By raising your sales price, you’re in turn raising the contribution price of each unit and lowering the number of units needed to break even.

While you’re at it, your business can start reducing plastic use and teach employees how to compost biodegradable waste. If you’re helping the local orphanage, you can provide a piggy bank jar for customers who want to donate loose change. Again, being part of an advocacy involves actively engaging with your community.