The entry on the books of the company at the time the money is received in advance is a debit to Cash and a credit to Customer Deposits. Here are a few reasons why reconciling your bank statements is so important. Hence, at the end of each month, the first thing to do is to consult the bank reconciliation statement prepared at the end of the previous month.

How to Do Bank Reconciliation: 5 Key Steps

Bank errors are mistakes made by the bank while creating the bank statement. Common errors include entering an incorrect amount or omitting an amount from the bank statement. These miscalculations can also occur on the business’s financial records. If your beginning balance in your accounting software isn’t correct, the bank account won’t reconcile. This can happen if you’re reconciling an account for the first time or if it wasn’t properly reconciled last month.

Not-Sufficient Funds Checks

This can be accomplished by matching transactions, and then adding or deducting any transactions that do not align to balance the total amounts. The more frequently you do a bank reconciliation, the easier it is to catch any errors. Many companies may choose to do additional bank reconciliations in situations that involve large sums of money or that show unusual financial activity. This can include large payments and deposits or notifications of suspicious activity from your bank. In these situations, it’s a good idea to perform an immediate reconciliation.

Example #4 of Bank Reconciliation Statement Template

If, on the other hand, you use cash basis accounting, then you record every transaction at the same time the bank does; there should be no discrepancy between your balance sheet and your bank statement. If you do your bookkeeping yourself, you should be prepared to reconcile your bank statements at regular intervals (more on that below). If you work with a bookkeeper or online bookkeeping service, they’ll handle it for you.

Other Post You May Be Interested In

- Популяризация интернет-площадки статьями

- Lumina Grand Showflat Tour: Discover What Luxury Really Means

- How to Secure Your Spot in Singapore’s Most Coveted EC: Lumina Grand

They also can be done as frequently as statements are generated, such as daily or weekly. Keeping on top of your bank reconciliation ensures that you’re always aware of your company’s financial situation. This helps you anticipate any cash flow challenges so you can respond appropriately. Financial accuracy is also important 8 inventory costing methods that you might not know about for ensuring that all payments have been fulfilled and orders have been completed. Greg adds the $11,500 of deposits in transit to his bank statement balance, bringing him to $99,500. He also subtracts the $500 in bank fees from his financial statement balance, bringing him to $99,500 and balancing the two accounts.

Recording bank reconciliations

Afterward your bank told you that Mr. X’s bank did not honor the check because there were not sufficient funds in his account. Your bank reduced your account by $1,000 and returned the dishonored check of $1,000 to you as NSF check. The balance shown by your accounting record will differ from your bank statement by $1,000. You issued a check to Mr. X (one of your creditors) for $500 on January 31, 2021 and entered it immediately in your accounting records. Mr. X did not present or deposit that check in his account before the end of January. Your bank statement for the month of January would not show the entry for that $500 because Mr. X did not present this check before the end of January.

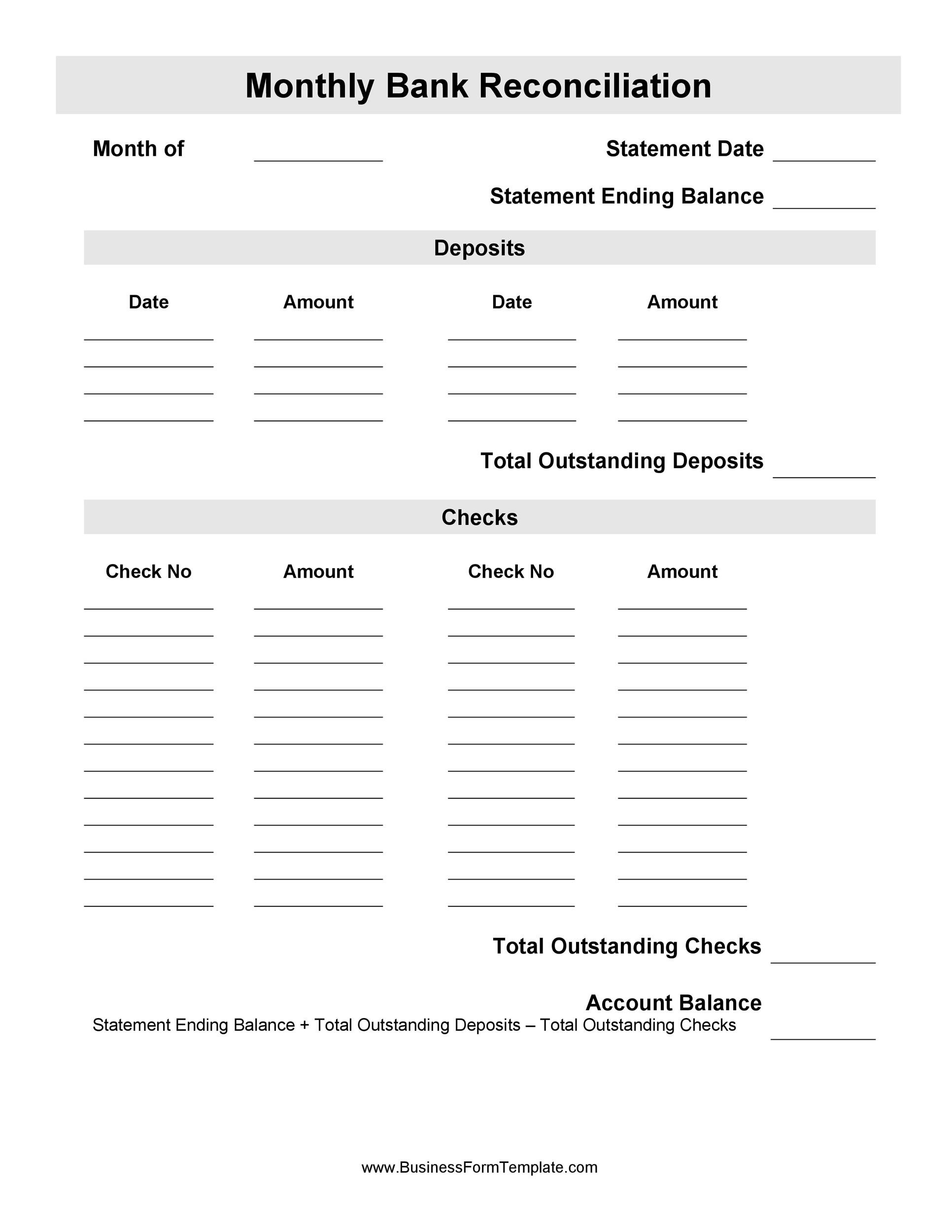

An online template can help guide you, but a simple spreadsheet is just as effective. In this case, the reconciliation includes the deposits, withdrawals, and other activities affecting a bank account for a specific period. Performing immediate bank reconciliations for large cash amounts or suspicious transactions further increases your ability to catch fraud and error. Go through both statements and highlight any transactions that appear on only one side. Note that transactions may take a few days to clear, so the transaction date in your financial records may not precisely match the date on your bank statement. Greg’s January financial statement for the company shows $100,000 in cash, but the bank statement shows only $88,000.

- All transactions between depositor and bank are entered by both the parties in their records.

- NSF checks are an item to be reconciled when preparing the bank reconciliation statement, because when you deposit a check, often it has already been cleared by the bank.

- Once you complete the bank reconciliation statement at the end of the month, you need to print a bank reconciliation report and keep it in your monthly journal entries as a separate document.

- If you do your bookkeeping yourself, you should be prepared to reconcile your bank statements at regular intervals (more on that below).

- One of the primary reasons this happens is due to the time delay in recording the transactions of either payments or receipts.

Note that Community Bank credits its liability account Customers’ Deposits (which includes the individual depositor’s checking account balance). As a result, Community Bank’s balance sheet will report an additional $10,000 in assets and an additional $10,000 in liabilities. When the bank debits a depositor’s checking account, the depositor’s checking account balance and the bank’s liability to the customer/depositor are decreased. When a company writes a check, the company’s general ledger Cash account is credited (and another account is debited) using the date of the check.