Match the deposits in the business records with those in the bank statement. A bank reconciliation statement is only a statement prepared to stay abreast with the bank statement; it is not in itself an accounting record, nor is it part of the double entry system. Additionally, bank reconciliation statements brings into focus errors and irregularities while dealing with the cash. Furthermore, they reflect the actual position in terms of bank balance. Making sure a company’s and its bank’s listed balances align is also a way to ensure the account has sufficient funds to cover company expenditures. The process also enables the company to record any interest payments the account has earned or fees the bank has charged.

How to reconcile bank accounts?

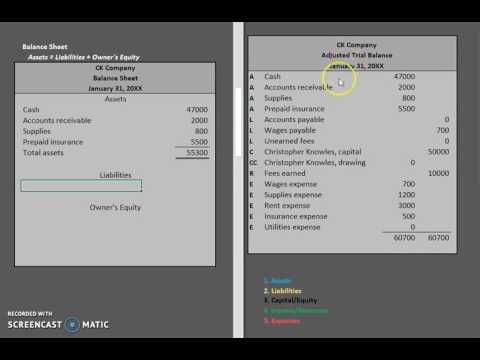

To reconcile your bank statement with your cash book, you need to ensure that the cash book is complete. Further, make sure that the bank’s statement for the current month has also been obtained from the bank. Once you complete the https://www.personal-accounting.org/vendor-financial-services/ at the end of the month, you need to print the bank reconciliation report and keep it in your monthly journal entries as a separate document. Journal entries, also known as the original book of entries, refer to the process of recording transactions as debits and credits. Once the journal entries are recorded, the general ledger is prepared.

Make Necessary Adjustments in the Balance as per cash book

If you use accounting software, then your reconciliation is done largely for you. However, as a business owner, it’s important to understand the reconciliation process. You should perform monthly bank reconciliations so you can better manage your cash flow and understand your true cash position. Read on to learn about bank reconciliations, use cases, and common errors to look for. Whatever method you prefer, it’s important to keep solid records of every transaction to reconcile your bank account properly. Once you have incorporated the adjustments in the bank reconciliation statement, you have to ensure that the totals of both sides mentioned at the bottom match.

Direct Deposits into the Bank Account

Keeping accurate records of your bank transactions can help you determine your financial health and avoid costly fees. Using this simple process each month will help you uncover any differences between your records and what shows up on your bank statement. In addition to ensuring correct cash records, the bank reconciliation process also helps in keeping track of the occurrence of any form of fraud. standard costing: a managerial control tool Such insights would help you as a business to control cash receipts and payments in a better way. Bank reconciliation is the process of matching the bank balances reflected in the cash book of a business with the balances reflected in the bank statement of the business in a given period. Such a process determines the differences between the balances as per the cash book and bank passbook.

If the deposit was made toward the end of the month, there would be no need to notify the bank. The reconciliation prepared by the accountant appears in below example. Bank reconciliations may be tedious, but the financial hygiene will pay off. They may not be fun, but when you do them on a regular basis you protect yourself from all kinds of pitfalls, like overdrawing money and becoming a victim of fraud.

How often should you reconcile your bank account?

Cash management software allows for scalability, making it easy to streamline the reconciliation process as the business grows. Standardizing the process with a set of steps to follow for reconciliation can make the process more organized and save time. This can be done by creating a checklist or using a reconciliation software tool. This practical article illustrates the key points of why a bank reconciliation is important for both business and personal reasons. The bank section lists items in transit from the depositor to the bank and bank errors. The book section lists items in transit from the bank, service charges, and depositor errors.

A monthly reconciliation helps to catch and identify any unusual transactions that might be caused by fraud or accounting errors, especially if your business uses more than one bank account. Reconciling your bank account should be done monthly to catch discrepancies early and keep financial records accurate. Businesses with high volume of transactions must reconcile their bank statements weekly or daily to manage cash flow efficiently. Reconciliation of bank statements is the process of comparing the transactions recorded in the company’s accounting records with the transactions listed on the bank statement.

Ideally, you should reconcile your books of accounts with your bank account each time you receive the statement from your bank. The bank may send you a bank statement at the end of each month, every week, or even at the end of each day in case of businesses having a huge number of transactions. The very purpose of reconciling bank statements with your business’s cash book is to ensure that the balance as per the passbook matches the balance as per the cash book. Interest is automatically deposited into a bank account after a certain period of time. So the company’s accountant prepares an entry increasing the cash currently shown in the financial records. After adjustments are made, the book balance should equal the ending balance of the bank account.

- Some people rely on accounting software or mobile apps to track financial transactions and reconcile banking activity.

- Bank reconciliation ensures your business’s internal financial records accurately reflect your cash flow.

- It helps identify discrepancies early and prevent errors from piling up.

- Typically, each bank account is represented by a separate general ledger account.

Similarly, some checks credited to the ledger account will probably not have been processed by the bank prior to the bank statement date. Finally, compare your adjusted bank balance to your adjusted book https://www.kelleysbookkeeping.com/ balance. Since you’ve already adjusted the balances to account for common discrepancies, the numbers should be the same. Note that this process is exclusively for reconciliations performed by hand.

For example, the payees may be contacted to determine if the checks have been misplaced. The $10,000 error is added because it understated the deposit and the account balance. Some businesses, which have money entering and leaving their accounts multiple times every day, will reconcile on a daily basis. There’s nothing harmful about outstanding checks/withdrawals or outstanding deposits/receipts, so long as you keep track of them. After adjusting the balances as per the bank and as per the books, the adjusted amounts should be the same. If they are still not equal, you will have to repeat the process of reconciliation again.

Bank reconciliation statements can help identify accounting errors, discrepancies and fraud. For instance, if the company’s records indicate a payment was collected and deposited, yet the bank statement doesn’t show such a deposit, there may have been a mistake or fraud. Consider performing this monthly task shortly after your bank statement arrives so you can manage any errors or improper transactions as quickly as possible. Regardless of how you do it, reconciling your bank account can be a priceless tool in your personal finance arsenal.

Connect QuickBooks to your bank, credit cards, PayPal, Square, and more1 and we’ll import your transactions for you. When you receive your bank statement or account statement at the end of the month, you’ll only spend a minute or two reconciling your accounts. QuickBooks organizes your data for you, making bank reconciliation easy.

This is a simple data entry error that occurs when two digits are accidentally reversed (transposed) when posting a transaction. For example, you wrote a check for $32, but you recorded it as $23 in your accounting software. The deposit could have been received after the cutoff date for the monthly statement release. Depending on how you choose to receive notifications from your bank, you may receive email or text alerts for successful deposits into your account.