Perhaps you have Fallen To own An internet Scam? Listed below are cuatro Warning signs

Despite the stories we hear and read, there are more exactly who treat wild quantity of difficult-generated money to on line scams. You might be next!

Understand work

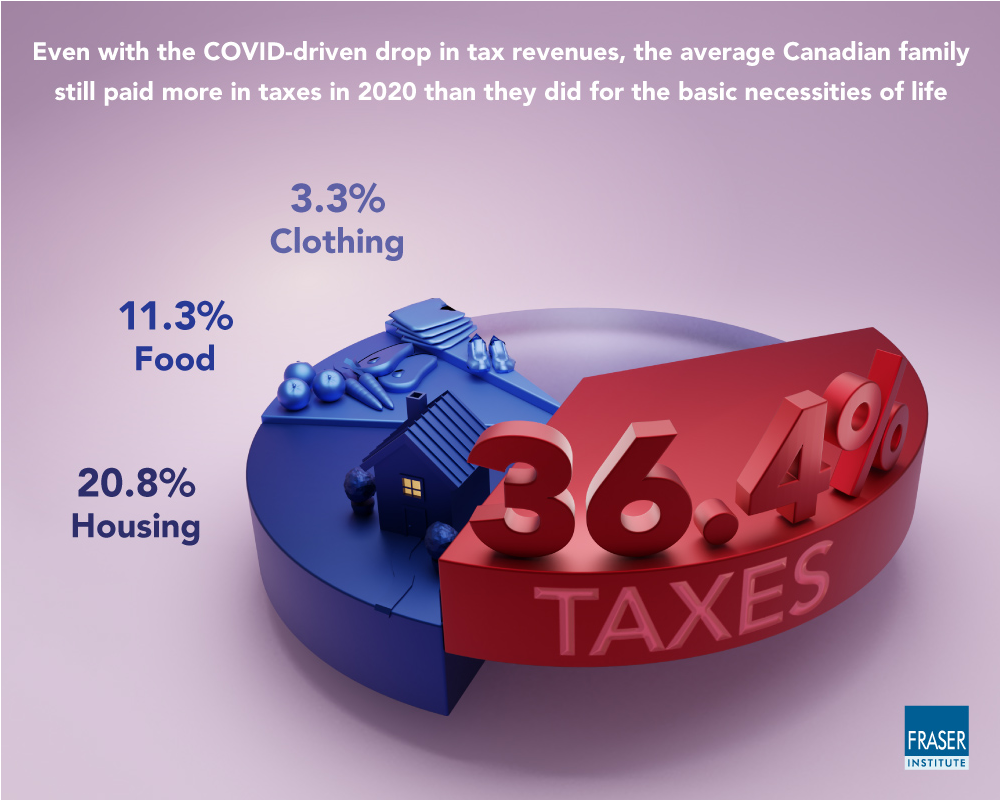

Of many on line scams today cover signature loans, the first step to end being scammed would be to know the way fund performs. An unsecured loan works in a similar manner as the virtually any style of mortgage. Basically, your borrow cash away from a lender or lender and that means you are able to afford stuff you prefer.

An agreement might be drafted because of the lender in which installment details, rates or any other miscellaneous facts was spelled out.

So it whole process does not require the financial institution to expend one contribution initial. Think about, it is unlawful for a loan provider to inquire of to possess pre-payment.

It is also crucial that you discover whom the brand new debtor are. Are you currently obtaining that loan of an authorized financial institutions eg a lender, or a money lender otherwise borrowing business? Finance out of subscribed creditors will probably be your trusted solution as the he’s regulated by the main lender.

Know the cons

Various other common strategy utilized by scammers try phishing. In this situation, scammers carry out impersonate a business. It is to help you key you into supplying your very own recommendations such financial and you may mastercard information including passwords.

Good scammer you are going to impersonate a well-identified standard bank otherwise a lending institution which have a valid lookin webpages, or even the common way which is via email.