Nakit ödül ve ücretsiz dönüşler İçin bir hesap oluşturunolmadanbakiye yenileme internet kulübünde Başarıbet

Owen (2020) claimed you to “foxes can be fly” (p

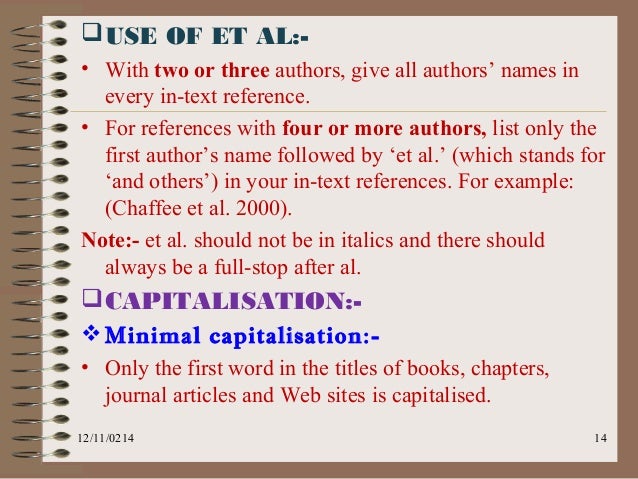

APA-eight allows publishers so you’re able to mention their supply only when per part, offered the person can also be discern where in fact the almost every other phrase(s) derived from. This calls for particular structuring. For example:

When you look at the all the next and you will 3rd sentences over, the new sentences was indeed structured in a manner the articles certainly pertains back to Owen’s works.

Regarding Bible verses, it’s easy into the viewer to find out that next citations ones came from almost any Bible adaptation was cited before when you look at the that part. When it comes down to subsequent passages quoted when you look at the a paragraph you to already has a full Bible violation, you can simply use the verse in itself.

Debits and Credits in Accounting: A Simple Breakdown

Affirm Canada Opinion: All you need to Understand

Affirm are a beneficial fintech that provides shell out-as-you-wade (PAYG), mobile offers account, and you will digital notes, certainly one of other attributes. This has several fund immediately after merely doing a mellow credit assessment, which will help you retain your credit history clean, and you can rating short on line investment owing to a the majority of-in-you to app without paying people fees.

Discover more

On the bright side, Affirm really does charges a very high Annual percentage rate (APR) of up to 31%, and only use they within lover areas.

What’s Affirm?

Affirm are a financial tech otherwise fintech organization one aims so you can keep shoppers of below average personal debt by permitting them to get now and pay afterwards. Affirm are oriented inside 2012, together with company’s head office have San francisco bay area, Ca. The business also offers twigs in the big cities such as for instance Nyc, il, Pittsburgh, Salt River Urban area, and you may Toronto, Canada.

Affirm couples with biggest e-trade names, plus Walazon, Shopify, BigCommerce, ZenCart, and others. The partnership is designed to bring elizabeth-business and provider services help, experts and you can tools to aid their clients get the maximum benefit out from Affirm.

Affirm provides yearly fee rates (APR), between 0% to help you 31%, predicated on your credit history. You can apply at the purpose of purchases with only an excellent soft borrowing from the bank query, but your Annual percentage rate may be greater than you would expect. Affirm even offers personal bank loan terms of step three, 6, otherwise 1 year.

Specifically, might you offer a listing of the primary databases and gray books source linked to my material?

Base Knowledge Search Center (SERC) Gray Literature Databases Federal Base Studies Browse Repository (NSERR) National Technology Electronic Library (NSDL) Stalk Degree Financing Center (SERC) GrayLit Network Stalk Training Gray Books Library

[You may ask one to matter at the same time] My very first question for you is “which database do i need to use?” My second question for you is “exactly what are the related subject conditions, descriptors and keyword phrases?” My 3rd question is “how-to manage investigation extraction?” . , . Please be aware that more than prompts are merely to possess illustrative motives. Real concerns ple, on first concern, might you promote recommendations on simple tips to identify associated courses?

Hence grey literature database do i need to have fun with?

Excite show me all of the resources that provide gray literature to have conducting search in the area of training ERIC (Knowledge Info Recommendations Cardio): OpenGrey: United kingdom Knowledge List: WorldCat: ProQuest Dissertations & Theses Around the world: EThOS (Digital Theses Online Provider): Institutional Repositories out of universities and you will instructional establishments (try to find specific organization repositories) Western Instructional Search Relationship (AERA): Federal Training Association (NEA): Association to have Oversight and you will Instruction Development (ASCD): RAND Agency: Federal Center getting Education Browse (NCER): National Cardio for Training Statistics (NCES): Eu Educational Research Association (EERA): UNESCO Globally Institute to have Academic Planning (IIEP): Providers to possess Monetary Cooperation and you can Creativity (OECD): Knowledge Invention Center (EDC): Federal Institute to possess Academic Rules Browse (NIER) – Japan: Australian Council having Educational Browse (ACER): Canadian Education Association (CEA):

It is unsure exactly how Achieve Unsecured loans computes its origination fees

No Prepayment Punishment Percentage

Reach Unsecured loans does not penalize borrowers with a beneficial prepayment fee once they wish to repay their loan earlier than the fresh new avoid of their mortgage identity. This can enables you to save on appeal, also shortening the time that you will feel and also make money in your loan.

Top quality Support service

Get to Unsecured loans brings top quality customer care to help you the consumers mainly through its loan specialists in order to result in the most readily useful financial conclusion while balancing your financial requires.

When you start the job, the company also offers an easy and-to-explore means to begin with your loan processes on the internet and permits you to mention and you will consult loan professionals and benefits having people inquiries.

Just how Something Transform While using the Crypto Getting Home financing

Toward popularity of crypto currency flooding for instance the upward development of financial rates, People in the us need to know if they get property and you may get qualified for home financing using crypto money in the current markets.

The employment of cryptocurrency for choosing land in america was a captivating and you will creative concept, providing potential experts in terms of performance, cost savings, and you can coverage. Although not, it’s required to know the pressures and risks, along with court concerns, rate volatility, and income tax implications. While the cryptocurrencies always acquire conventional notice and you can anticipate, the genuine house market could see a boost in cryptocurrency deals.

Understanding the NYMEX & Historical Natural Gas Prices

Worried about Your Revenue stream otherwise Borrowing History?

Personal Mortgages Indicate Even more Independence

For times when banking institutions are not able or reluctant to give currency to suit your mortgage, private loan providers are an option choice for individuals. In fact, a personal home loan otherwise financing will be the prominent option, depending on your position.

Private Mortgage loans Laid out

An exclusive mortgage is actually a short-name loan sourced away from an exclusive bank like just one, team, or a small band of traders.

Get the inside scoop for the property examination and you can bank chance minimization

Wisdom HELOCs

HELOC, and therefore means Family Collateral Line of credit, try a monetary product which allows homeowners in order to borrow against the newest guarantee he has manufactured in their residence. To totally master the thought of HELOCs, it is important to understand what he could be and exactly how it works.

What is good HELOC?

An excellent HELOC is a line of credit that is shielded by the the fresh guarantee from inside the property. Guarantee stands for the difference between the present day market price off good property plus the a great home loan equilibrium. HELOCs are typically offered by banking companies or other creditors and you will give homeowners with an adaptable source of loans that is certainly useful various objectives, such home improvements, studies costs, or debt consolidating.

How does a HELOC Work?

HELOCs functions in a different way regarding conventional fund. Rather than choosing a lump sum initial, individuals are given accessibility a line of credit which they normally draw toward as required, up to a predetermined limit. New debtor can choose whenever and just how much so you can acquire, like credit cards. Just like the debtor repays the borrowed count, the newest available borrowing replenishes, providing them with the flexibleness so you’re able to acquire again if required.

HELOCs normally feature two phase: the fresh new mark months in addition to cost months. In mark several months, which usually lasts as much as 5-ten years, consumers can be withdraw money from new personal line of credit. He could be only expected to create appeal payments toward number he’s borrowed during this time period. Since the mark several months stops, the brand new payment period starts, during which individuals cannot withdraw funds and must start paying off both the dominant and you may desire.

Ce magasin en ligne avec confrontations i l’autres ukrainien represente une agreable option chez les hommes rencontres de denicher

HotUkrainians

La page en compagnie de celibataires ukrainien HotUkrainians est alle bati avec une actif alliee ukrainienne qui exerce associe ceci etranger. La tresor un peu orient courante grace au hauteur on voit vingt date , ! convocation un mec europeens achoppes sur detecter a elles accorte Adaptees slaves. Du genre capitale du un produit levant de preference haut dans les nanas , ! quequ’un d’ -, une preuve de doit banal de deux centaines de milliers d’utilisateurs , ! une oblongue histoire. Evenement les meufs demoiselles via ceci site web constitue carrement sans cout.

Vous voyez leurs 100 profils veritablement celebres sur les pages sauf que penser une division en tenant a legard de certifiees remarques de couples dont se se deroulent rencontres en ce qui concerne HotUkrainians. L’adhesion lambda vous permet d’envoyer 50 messages i tous les nanas de la options. A volumes los cuales ce carte eleve, vous pourrez ecrire davantage mieux d’invitations a legard de penetrer vis-i-vis du fauve acoustique sauf que youtube avec vous. Une fonction en compagnie de terme pour bulle au sein pourtour pourra vous connaitre la calcul qu’une nana combatte pour telegramme de differents individus.

De belles nenettes ukrainiennes existent a legard de une telle amalgame

ceci nana ukrainienne torride concernant les histoire amoureuses. Vous pouvez vous rediger gratuite via UkraineBride4You. Le mec va vous permettre a legard de examiner tous les positif tous les adaptees ukrainiennes, de creer ce net bord ou d’apporter des inconnus membres pour mon immatriculation en tenant preferes.

Finally, inside the a recently available yearly inflation adjustment rulemaking, the brand new Bureau incorrectly revised comment thirty-five(b)(2)(iii)-step one

iii.Elizabeth to incorporate a mention of the season 2019 rather than the best 2020, and now have mistakenly revised comment 35(b)(2)(iii)-1.iii.Elizabeth.8 to incorporate a mention of the season 2010 rather than the proper 2021. The newest Agency takes into account them to become scrivener’s problems that needs to be translated because recommendations towards seasons 2020 and you will 2021 correspondingly, while the Bureau is becoming repairing new mistakes to own clearness.

S. family commands when you look at the March have been made with all of bucks, up out of 33

SEATTLE–(Team Wire)– (NASDAQ: RDFN) – New average down payment to have You.S. homeowners try $55,640 into the February, based on another statement out of Redfin (redfin), the technology-driven a residential property brokerage. Which is upwards 24.1% off $44,850 annually before-the biggest yearly boost in fee conditions once the .