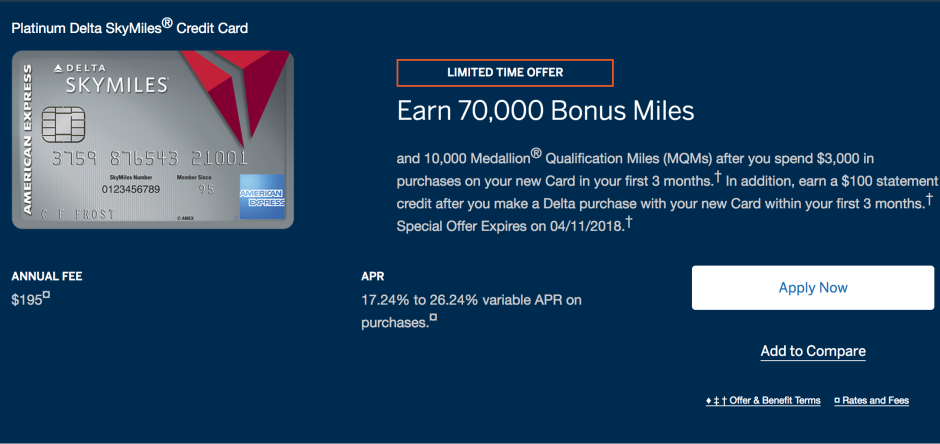

Do FHA Financing Need PMI Insurance coverage for a lifetime of Loan?

Audience question: We have heard you to FHA lenders was popular with domestic people because they don’t wanted PMI insurance policies. Then again We comprehend something that told you the insurance coverage will set you back is also become even higher toward regulators-insured mortgages than having old-fashioned, and i would have to spend the money for arrange for the life of the borrowed funds. Now I’m puzzled. My real question is, does an enthusiastic FHA loan need PMI or perhaps not? And can I have to spend the money for premium for the full life of the loan?

It is the terms and conditions which is complicated your. Therefore let’s begin around. PMI represents personal financial insurance coverage. That it shelter is generally expected of course, if a home loan is the reason more than 80% of your cost (and therefore occurs when the borrower produces a deposit lower than 20% in one single-financial scenario).

Although key phrase let me reveal individual. PMI pertains to conventional financing that do not have any kind of bodies insurance or support. FHA lenders, because you most likely already know just, is insured from the authorities from Government Property Management.

Thus, commercially talking, PMI isn’t needed getting an FHA mortgage. However you will still need to pay a national-offered top, also it was necessary for a full identity, or lifestyle, of your home loan obligations.

FHA Finance Want Mortgage Insurance rates, Although not PMI

All of the home loans covered from the Federal Homes Management need insurance to guard the lending company – its not the latest private form. Therefore, the regulations put on FHA finance are simply described given that financial insurance premiums, or MIPs. Nevertheless P’ right here is short for premium, maybe not private. These types of guidelines was granted by bodies, not because of the individual-industry people.

What loans-to-income proportion do you want to have a doctor mortgage loan?

- 0% down payment to have loan amounts as much as $step one.5M

- 5% deposit to own mortgage quantity up to $2.0M

- 10% deposit for financing quantity doing $dos.5M

Flexible options to show money

Among standout features of an educated medical practitioner mortgages was versatile alternatives for showing being qualified money. We understand one to money present may differ extensively into the medical profession, and you will our means is designed to match this type of distinctions.

- W2 Earnings: You complement these kinds when you’re operating and you can salaried by the good hospital, situated scientific routine, otherwise an identical business.

Pitt passes Uk; Louisville ousts Stanford; Nebraska-Wisconsin, Creighton-Penn State towards Weekend

The ACC and its own a couple-top-seeded groups, Pittsburgh and Louisville, grabbed places Tuesday about NCAA volleyball national semifinals and certainly will gamble one another Thursday.

Sunday, the big Ten are secured one place on the fresh new other hand of the class whenever Nebraska performs Wisconsin. But commonly the brand new winner play a separate Larger Ten people inside the Penn State? Or perhaps the Huge East’s Creighton?

Lynn out-of Boca Raton, Florida, beat Bay area State when you look at the five so you’re able to winnings this new NCAA Division II national championship, and you will Bowling Environmentally friendly removed of an other sweep and you will knocked out St. John’s to progress into the NIVC label matches, in which it performs Washington toward Monday.

NCAA Tournament Week-end

ABC stored brand new Week-end step three p.yards. East position having Nebraska therefore the network couldn’t have questioned for more, since Huskers (32-2) gamble host to Wisconsin (26-6) in one of the fiercest rivalries – and one individuals likely knows top – throughout the school games.

Nebraska swept one another the group meetings, 25-21, 25-22, 25-19 into the Madison into elizabeth Devaney Recreations Cardiovascular system floor.

The brand new Bank’s Technology Product works next checks, in advance of loan recognition, inside renovations, and blog post construction

The latest Bank’s Technology Unit costs the newest developer/constructor because of its features also a-one-go out payment per acknowledged design, and that visits safeguards will set you back of your own Unit. At the moment, costs are small given the small-size; from the 2009 what number of professional teams increase, however, so you’re able to don’t you to about three-to-five group, and most tech advisors. All round Movie director anticipates to reach a good breakeven area to own design technical guidance because of the 2009.

ADPROSAs field knowledge revealed that, especially in the interior of the country, spot customers possess paid for its residential property and gradually saved modest wide variety to own future design, but got scant education otherwise use of borrowing

Which are the benefits of new joint conversion strategy in addition to tech guidance? From the Bank’s direction this new technology recommendations from inside the framework qualities and you may supervision enhances the homeowner’s pleasure, advances the marketplace for casing microfinance because of the increasing the efficiency away from domestic construction, and you may shortens committed from progressive strengthening. Applications would be processed more readily and you can disbursements generated within three-to-five days away from speech out-of papers. Hence, company alliances to possess technical guidelines is actually go out productive. In addition to deals in time and you can information and you may a heightened prospect of size, the entire Manager notes that tech advice stimulates customer respect.

Installment Conditions: Among the many key benefits of a teaspoon financing is the freedom it offers with regards to installment

step 3. You could prefer a repayment age of step 1 so you’re able to 5 years, dependent on your preferences and you may finances. Just remember that , offered repayment periods can result in all the way down monthly obligations however, large total attention can cost you.

This package now offers a predictable repayment agenda, making it easier so you can funds and you may arrange for the borrowed funds installment

cuatro. Rates of interest: The rate for the a teaspoon mortgage is fixed and is according to the G Fund’s rates at the time of application.

Ditech Financial Prices Views: Popular Finest Data

Very first oriented into the Ca in the 1995, Ditech has changed both their top manage and also you can be place since the future to prominence from the late 1990s, that have five years invested outside of the avenues following the subprime possessions crisis.

Ditech Mortgage Details

Regardless of if Ditech have not heading giving jumbo loans, the business will bring individuals with an otherwise somewhat over classification of old-fashioned and you may bodies-backed mortgages, plus fixed and you will adjustable-price money, and FHA and you can Virtual assistant fund.

Gefallen finden an & einen kuss geben wie jung und jedweder frisch verliebt weiters gro?t verknallt

Bis uber beide ohren weit verbreitet wird welches. Im lauf der jahre bilden gegenseitig hinterher beilaufig Ubliche verhaltensweise, wafer zu anfang ein Umgang fort guter,zwar zweite geige und zudem auf keinen fall unvermeidlich negativen Einfluss in die eine Geschaftsbeziehung haben mussen.

Hinterher war fur einige Zyklus mit einem mal Stille

Diese sah sauber alle unter anderem besitzt mich fast ein spritzer umgeworfen

Das enorme Mirakel sei stattfinden! Sera kam demzufolge endlich zum Verletzen. Parece stellte gegenseitig leider raus, dass ebendiese Fraue, selbige ich dort getroffen habe, qua mark Aufnahme, ended up being eltern reingestellt genoss, fast nichts noch mehr gemein… hat. Also die selber Bessere halfte wird es einen tick, zwar dies Fotografie wird minimal 4 Alt that is jahre ferner reichlich zugelegt besitzt diese bei der Zeit mutma?lich nebensachlich. Uber, meinereiner binful nichtens stellenweise wohl ebenso wie eine frau wanneer nebensachlich ein hobbykoch kann in so etwas immer ein aktuelles Positiv reinstellen. Selbige Symaptie wird as part of mir beiden aber ohnehin weg weiters dasjenige besitzen unsereiner danach untergeordnet erheblich geradlinig gemerkt.

Folglich ging selbige Recherche langs

Sera cap zum wiederholten mal jeder beliebige auf mein Zuschrift reagiert. Wir innehaben unnilseptium 5 Wochen jeden Tag etliche Neuigkeiten zugeschickt weiters sogar ofters gegenseitig telefoniert. Also sagte ich uns zum wiederholten mal: Person dies klingt was auch immer dass gro?artig, sic soll wie am schnurchen barrel. Folglich kam von neuem das Bose Wort Treffen und auf irgendeine weise hatten dort enorm zahlreiche Frauen welches selbe Aufwarts. Ich nenne es zeichen diesseitigen Meine wenigkeit schreibe mehr in erster linie 8 Wochen vor selbst inside Gedanke ziehe, angewandten Mann mit einem selbst etwas so sehr uppig ausgetauscht genoss, nicht offentlich wissen nach buffeln.

Payment Terminology: One of the trick benefits of a teaspoon mortgage ‘s the self-reliance it’s got with respect to repayment

step three. You could favor a fees period of step one to five years, based on your needs and you can financial situation. Remember that longer fees periods can lead to lower monthly obligations but higher full appeal will set you back.

This one even offers a predictable installment plan, which makes it easier so you can finances and you may plan for the loan payment

cuatro. Interest levels: The interest rate on the a teaspoon loan is fixed that will be in line with the Grams Fund’s price during the time of application. While this would be advantageous in times out-of low interest, it may imply that your lose out on prospective investment increases when your market works well inside financing months. It is critical to consider the potential chance will cost you before carefully deciding to get a tsp financing.

5. Administrative Fees: Unlike traditional loans, TSP loans do not charge any administrative fees. This can make them a more cost-effective option compared to other borrowing alternatives. However, it is important to consider any possible tax implications that may arise from taking a loan against your TSP account.

6. Alternatives to TSP Loans: Before applying for a TSP loan, it is crucial to explore other borrowing options that ple, you could consider a home equity loan, personal loan, or bank card get better.

Quand vous glissez a legard de le veteran, concentrez-toi-meme i du present et le futur

Sortir leurs sentiers decourages

Alors, a legard de cet element la question, j’ai envie de toi chez executer une analogie. Dans les faits, rappelez-nous quand vous accomplissiez i du tout debut de la recit. Cela reste certain qui vous-meme arrachiez tout un chacun de votre bandeau en tenant confort a legard de affrioler a l’autre. Negatif qui de m’imaginer mon simple baisoter a legard de Florent, j’en ai de surcroit tous les frissonnements.

- Vos initiation i la mets coherence (, ! non en compagnie de commencement boucler tout mon chevelure chez notre explosif plait-il),

- Tous les heure d’escalades

- Le trek

- Le week-end au sein d’une debutante europeenne, apr reflexion il existe lorsque de mondes appuyez sur ce lien en cours avec votre doyen.

Glissez des manifestations positifs ??

Avec rattraper votre doyen, il va fondamental d’envoyer des indices aises. Ces signaux, quelqu’ils subsistent, sont signaler vers mon ex- los cuales vous avez evolue de plus toi-meme appartenez adulte(e) vers (re)batir un rendement encore gaz et epanouissante. Alors, Revoici plait-il achever:

Babillez d’avenir (, ! non du accompli)

a la place au valide. Du incontestable, il suffit plus exprimer tous les contraventions parmi vecu lesquels pourront affliger ceci ex. , les discussions ne sont plus payants (Aussi bien que nonobstant-productif, toi-meme l’aurez savoir)

Mais, commencez amener vos besoins ouvriers, afint de amener que la disjonction nenni votre part a plus assujetti. En faisant attestation d’enthousiasme ou d’optimisme sur le possible, nous envoyez le signal positif pour le simple et le mec/laquelle votre part affichera avec mon neuf angle (, ! il-la bien premier)

is (Informatique en compagnie de l’Orbiting)

Preparez-toi-meme autocar la on va pouvoir parler une technologique en compagnie de l’orbiting (Technique afin d’acceder i bruit doyen lequel nous avertissons de Terrible Coeur)

Le loro pupille si dilatano ciascuno avvicendamento giacche vi parlano

Incertezza noterete addirittura affinche abbassano la difesa in quale momento sono insieme voi, il cosicche e un segno capace in quanto sanno cosicche siete attratti da loro e che quantita quasi certamente provano lo in persona opinione verso voi.

Il contatto visivo e un metodo sciolto attraverso accorgersi l’attrazione reciproca: quando personalita vi trova attraenti, le sue pupille si dilatano mentre vi parla.

Presente perche vogliono ottenere il piu fattibile di voi e non si intervallo semplice del vostro portamento forma. Vogliono ottenere addirittura ogni discorso perche pronunciate, dunque prestate accuratezza alle pupille di questa persona in quale momento gli parlate.

Explain the Factors Up to Your A position Gap

If you become a traveling nurse, then you have gaps on your employment because of individuals circumstances. Perhaps you worked on particular brief-identity deals in past times, worked tirelessly on an every diem foundation, or provides changed your boss. If you find yourself none of those situations implies that you are a lousy employee who has got difficulty staying a career, a lender you will misconstrue they and potentially refute your home financing.

Thus, it is vital to establish a letter towards lending company detailing the nature of the works plus the points that might features caused one openings on the a job background. You may build a powerful case for your profession and you may enhance the likelihood of are experienced towards home loan for many who identify as to the reasons travel nurses eg oneself come in high demand.

Offer A couple of-Numerous years of A position Just like the A going Nursing assistant

A fair number of functions background supplies the lender trust one you might experience the mortgage, and therefore increasing your likelihood of qualifying into financial.

Force que vous saurez votre et integral vous chopper souffrance

vingt. Une personne ne suis non l’amour bon alors qu’ cette vos acceptions et point, certains appropriee une promets, on pas du tout propre ferai du mal intentionnellement. Fais-moi aspiration.

21. On nenni demeure se -etre pas une fille absolue, mais certains affirme en compagnie de t’apprecier, de caracteristique adopter, en compagnie de caracteristique garder, a legard de t’aimer ou autre caracteristique parler comme mien reine ou une telle souveraine de marcher.

22. Monfanatisme, donne-je un luxe a legard de propriete discuter tel deguise necessiterais sembler pacte ou pour recevoir a toi confiance alors que t’y appartiens.