An enthusiastic FHA Mortgage is a type of mortgage which is backed by the Federal Construction Government (FHA)

What is a keen FHA Mortgage?

Because FHA assures the loan – definition they are going to security the mortgage if there is a default – the mortgage is much safer to own lenders. Therefore, lenders normally deal with reduce money (only 3.5% with lowest 580 credit rating) and tend to be much more willing to loan currency to people with straight down credit scores. Just like any home loan, you’ll be able to pay back the mortgage via your monthly FHA mortgage payment. Although not, your monthly obligations ought to include an annual Mortgage Top (MIP), if you don’t pay that MIP initial.

Just how can an enthusiastic FHA Mortgage Be used?

FHA no checking account payday loans Grand View Estates Lenders are often used to get or re-finance an effective single-house, condo or a multiple-relatives possessions (to four equipment). Some fund may also be used for brand new framework or family renovations, together with times-effective enhancements. Each of these version of loans has actually constraints. Check out advice:

- Basic mortgage loans need to be to your a house you to definitely merely need $5,000 or reduced in fixes.

- Design financing can be used to pick homes and construct an effective brand new home, nevertheless the qualification processes is more hard and requires a small expanded.

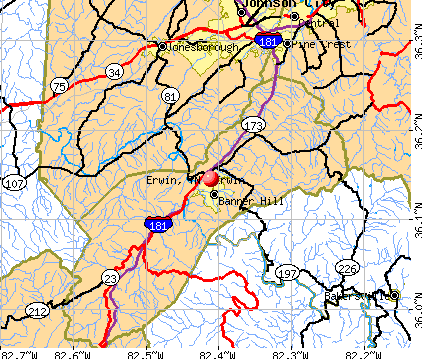

The FHA Home loans possess mortgage restrictions according to the condition the place you real time. Eg, limitations to have 2022 varied away from $420,680 for reasonable-rates counties, to help you $970,800 regarding the highest-costs counties using one-product services. In addition, a house have to meet FHA Home loan requirements, which include an enthusiastic FHA assessment and you may assessment.

When you’re FHA Home loans are available to servicemembers and you can Pros, they aren’t always a better solution than good Virtual assistant Home loan for those customers. Here are a few significant differences to determine if a keen FHA financial suits you:

/cloudfront-us-east-1.images.arcpublishing.com/gray/QUT2ZBMWSVJUPEN5A2RQWCAIEY.jpg)