Points to consider When Resource Window Replacement for

Screen replacement are going to be expensive however, capital is often available. Property owners get lower-notice commission plans out-of screen companies inside their town.

Screen substitute for is expensive, but the return on your investment for the energy savings and you may a keen boost in domestic well worth pays for alone over time.

This article even offers helpful information towards comparing funding selection out-of window enterprises and you can 3rd-group loan providers. Uncover what to anticipate out of replacement screen organizations that have fee agreements in your area otherwise demand a quote below.

Exactly what will an upgraded windows prices and will We afford the commission? payday loans in Bear Creek AL There are numerous alternatives for going for ideas on how to money your own substitute for screen. Ideally, you will want to build a knowledgeable choices you to definitely helps you to save the absolute most money and offers a simple software processes.

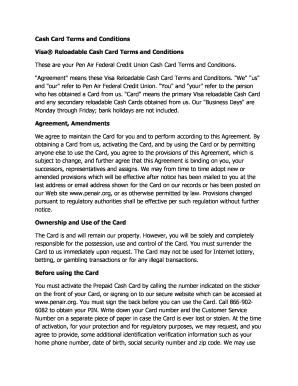

Household Guarantee Line of credit (HELOC)

Such funding is a rotating borrowing from the bank amount where you reside put because the security. The total amount that you have currently reduced on the prominent from the financial will give you equity as you are able to borrow against.

Youre acknowledged for a credit limit, and as you have to pay on the harmony, the level of offered borrowing try recovered. The latest draw months with this variety of line of credit is usually ten years with full fees inside the 2 decades.

Good HELOC might be an effective selection for men and women homeowners you to definitely possess several do-it-yourself systems plus don’t want to reapply to own loans with every brand new project.

Family Guarantee Financing

This type of funding is a lot like a great HELOC since your home is utilized since guarantee. You are also tapping into new equity you may have gathered through payments on the prominent of your home loan.