Ultimately, the decision comes down to each business’s specific needs and circumstances. Finally, once the customer has paid their invoice, reconcile the payment. An efficient reconciliation process ensures that your books stay up to date and that you’re prepared if your business is ever audited. This article will look at what accounts receivable are, as well as how your business can track and process accounts receivable payments. Your accounting needs might be modest today, but they may not stay that way forever.

How the Bench App Helps You Assess the Health of Your Business

The list of products below is based purely on reviews and profile completeness. There is no paid placement and analyst opinions do not influence their rankings. We are committed to ensuring information on our site is reliable, useful, and worthy of your trust.

Accounts receivable vs. accounts payable

First, ensure that invoices are sent out promptly and in line with agreed payment terms. Accounts receivable management has a ripple effect on your business, influencing customer relationships, cash flow, available capital, and ultimately, your bottom line. Satisfied customers are more likely to pay on time and maintain a positive business relationship. Clear communication and efficient payment processes contribute to higher customer satisfaction levels. Once you’ve outlined these parameters, consider the customer’s payment history, cash flow and value as a customer.

Resources for Your Growing Business

Free accounting software can be a hub for all of this data, though it often has fewer features and less automation than paid accounting software products. The most important aspect of managing accounts receivable is maintaining a positive cash flow by promptly collecting payments from customers. Additionally, effective communication and strong customer relations are crucial for a smooth and efficient accounts receivable process. The primary goal of accounts receivable management is to ensure the timely collection of payments owed by customers for goods or services provided on credit.

Other Post You May Be Interested In

They ensure that the goals of the branch are met in the most efficient way possible. They balance the needs of both the organization and the employees in the department. Branch managers are also expected to have calculating the cost of goods sold a hand in training the employees to be useful members of the organization. We are looking for an Accounts Receivable Manager to oversee the entire process of collecting payments from our company’s customers.

- If you have a good relationship with the late-paying customer, you might consider converting their account receivable into a long-term note.

- Before deciding whether or not to hire a collector, contact the customer and give them one last chance to make their payment.

- The value of your invoice, which represents a month’s worth of work, is part of your accounts receivable.

- Many of the household accounting software names, such as QuickBooks, Xero and Zoho Books, can be classified as integrated accounting software solutions.

- The easiest way to handle bad debts is to use the direct write-off method.

Accrual accounting

The software reduces human intervention and errors, increases accuracy and efficiency, and improves cash flow. It allows accounting departments to handle large numbers of invoices and payments. The debit offset for this entry generally goes to an expense account for the good or service that was purchased on credit. The debit could also be to an asset account if the item purchased was a capitalizable asset.

It’s essential for managing a smooth transition from sales to revenue and ensuring that a business maintains a healthy cash flow. The disparity between the goals https://www.accountingcoaching.online/ of the sales and finance departments can lead to conflicts. While the sales team aims to increase sales, the finance team focuses on reducing bad debt.

If you can’t contact your customer and are convinced you’ve done everything you can to collect, you can hire someone else to do it for you. Company A promptly brings in a mediator, who reminds Company B that the delivery charge was outlined on the sales order. Additionally, you can streamline the invoicing process with meticulous attention to detail. Implementing automation within this process not only reduces clerical errors but also serves as a safeguard against fraudulent activities.

This influences which products we write about and where and how the product appears on a page. Direct two-way sync runs automatically or on-demand with leading accounting systems including NetSuite, Sage Intacct, QuickBooks, Microsoft, and Xero. [Call to Action] Use this portion of the job description to provide the next steps to candidates so they know how to apply to the position. If you’re sending them to your website, include a direct link to your application portal. This Accounts Receivable Manager job description template is optimized for posting to online job boards and careers pages.

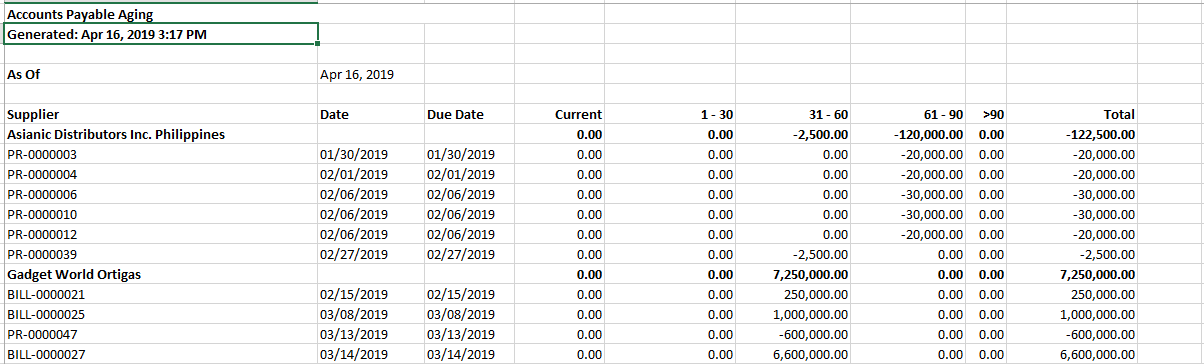

A company’s total accounts payable balance at a specific point in time will appear on its balance sheet under the current liabilities section. Accounts payable are obligations that must be paid off within a given period to avoid default. Every business should maintain a written procedures manual for the accounting system, and the manual should include specific procedures for managing accounts receivable. A procedures manual ensures https://www.business-accounting.net/what-are-the-differences-between-job-costing-and-contract-costing/ that routine tasks are completed in the same manner each time, and the manual allows your staff to train new workers effectively and effortlessly. Liquidity is defined as the ability to generate sufficient current assets to pay current liabilities, such as accounts payable and payroll liabilities. If you can’t generate enough current assets, you may need to borrow money to fund your business operations and logistical costs.