They were acquired by borrowing money from lenders, receiving cash from owners and shareholders or offering goods or services. Additionally, you can use your cover letter to detail other experiences you have with the accounting equation. For example, you can talk about a time you balanced the books for a friend or family member’s small business. An asset can be cash or something that has monetary value such as inventory, furniture, equipment etc. while liabilities are debts that need to be paid in the future.

What is your current financial priority?

The following illustration for Edelweiss Corporation shows a variety of assets that are reported at a total of $895,000. Creditors are owed $175,000, leaving $720,000 of stockholders’ equity. One of the main financial statements (along with the balance sheet, the statement of cash flows, and the statement of stockholders’ equity). The income statement is also referred to as the profit and loss statement, P&L, statement of income, and the statement of operations.

What is the approximate value of your cash savings and other investments?

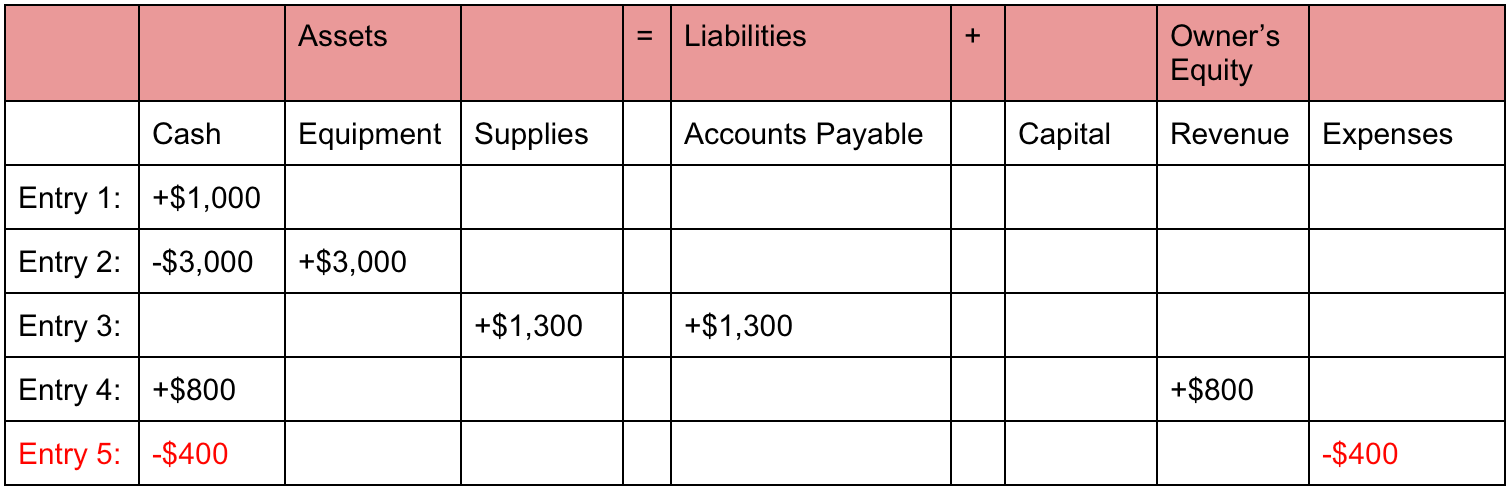

Its applications in accountancy and economics are thus diverse. These are some simple examples, but even the most complicated transactions can be recorded in a similar way. This equation is behind debits, credits, and journal entries. This number is the sum of total earnings that were not paid to shareholders as dividends.

Shareholders’ Equity

For example, if you have a house then that is an asset for you but it is also a liability because it needs to be paid off in the future. This transaction would reduce cash by $9,500 and accounts payable by $10,000. The difference of $500 in the cash discount would be added to the owner’s equity. On 12 January, Sam Enterprises pays $10,000 cash to its accounts payable. This transaction would reduce an asset (cash) and a liability (accounts payable). On 10 January, Sam Enterprises sells merchandise for $10,000 cash and earns a profit of $1,000.

This business transaction decreases assets by the $100,000 of cash disbursed, increases assets by the new $500,000 building, and increases liabilities by the new $400,000 mortgage. That part of the accounting system which contains the balance sheet and income statement accounts used for recording transactions. Like any mathematical equation, the accounting equation can be rearranged and expressed in terms of liabilities or owner’s equity instead of assets. Before explaining what this means and why the accounting equation should always balance, let’s review the meaning of the terms assets, liabilities, and owners’ equity. Notice that every transaction results in an equal effect to assets and liabilities plus capital.

For example, if the total liabilities of a business are $50K and the owner’s equity is $30K, then the total assets must equal $80K ($50K + $30K). The income and retained earnings of the accounting equation is also an essential component in computing, understanding, and analyzing a firm’s income statement. This statement reflects profits and losses that are themselves determined by the calculations that make up the basic accounting equation. In other words, this equation allows businesses to determine revenue as well as prepare a statement of retained earnings. This then allows them to predict future profit trends and adjust business practices accordingly. Thus, the accounting equation is an essential step in determining company profitability.

- The remainder is the shareholders’ equity, which would be returned to them.

- The revenue a company shareholder can claim after debts have been paid is Shareholder Equity.

- The impact of this transaction is a decrease in an asset (i.e., cash) and an addition of another asset (i.e., building).

- That is, each entry made on the debit side has a corresponding entry (or coverage) on the credit side.

- The accounting equation shows how a company’s assets, liabilities, and equity are related and how a change in one results in a change to another.

The major and often largest value assets of most companies are that company’s machinery, buildings, and property. These are fixed assets that are usually held for many years. Accounts receivable list the amounts of money owed to the company by its customers for the sale of its products. Assets include cash and cash equivalents or liquid assets, which may include Treasury bills and certificates of deposit (CDs). Metro Corporation earned a total of $10,000 in service revenue from clients who will pay in 30 days. Unearned revenue from the money you have yet to receive for services or products that you have not yet delivered is considered a liability.

11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site.

You can find a company’s assets, liabilities, and equity on key financial statements, such as balance sheets and income statements (also called profit and loss statements). These financial documents give overviews of the company’s financial position at a given point in time. The accounting equation ensures the balance sheet is balanced, which means the company is recording transactions accurately. It is sometimes called net assets, because it is equivalent to assets minus liabilities for a particular business.

However, due to the fact that accounting is kept on a historical basis, the equity is typically not the net worth of the organization. Often, a company may depreciate capital assets in 5–7 years, meaning that the assets will show on the books as less than their “real” value, or what they would be worth on the secondary market. xero vs quickbooks is a concise expression of the complex, expanded, and multi-item display of a balance sheet.

Ted decides it makes the most financial sense for Speakers, Inc. to buy a building. Since Speakers, Inc. doesn’t have $500,000 in cash to pay for a building, it must take out a loan. Speakers, Inc. purchases a $500,000 building by paying $100,000 in cash and taking out a $400,000 mortgage.