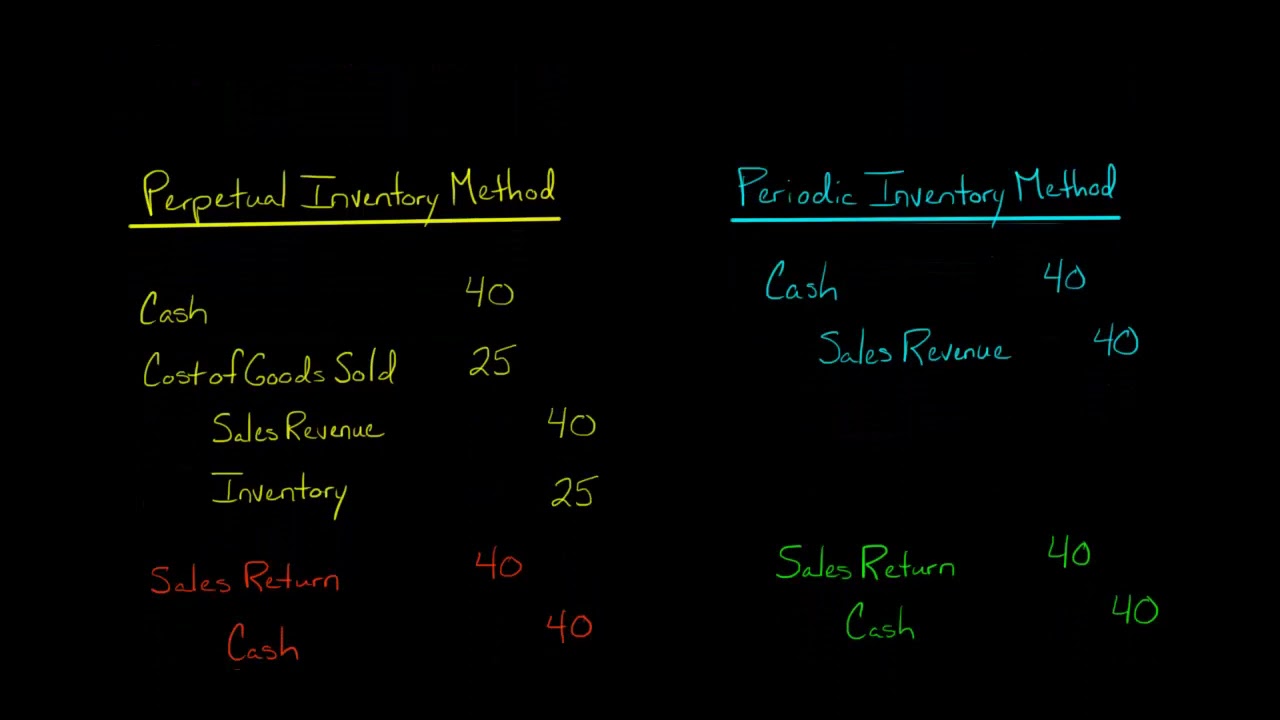

Thus, the term credit memorandum indicates that the seller has decreased the customer’s account and does not expect payment. However, to improve the bookkeeping process, returns and allowances are often recorded in a separate account entitled sales returns and allowances. Under the perpetual inventory system, there is an additional entry to include the cost of goods sold and its correspondence entry of merchandise inventory. This is because the sales return and allowances result in a reduction in the cost of goods sold and an increase in merchandise inventory. The refunds and allowances discussed above are accounted for by maintaining an account known as the sales returns and allowances account.

How to Record a Sales Journal Entry [with Examples]

- Then, an adjusting journal entry can be made to show that payment has been received.

- You can then create journal entries from the beginning that will automatically debit this new account on all future transactions.

- This allowance should not be confused with the sales discount, which is initially entered in the cash receipts journal at the time of receiving cash from buyers.

- Usually, these are a part of the net sales calculation in the notes to the financial statements.

- When recording sales, you’ll make journal entries using cash, accounts receivable, revenue from sales, cost of goods sold, inventory, and sales tax payable accounts.

Conversely, if the sale was made against cash, the journal entry will require the same account to be debited but the credit will be against cash or payable to the customer account. When making a sales returns and allowances journal entry, businesses need to account for both the debit and credit sides of the transaction. The sales returns and allowances journal is a special journal maintained to record the return of inventory from buyers or any allowance granted to them. As we can see from the journal entries above, the seller should debit the exact amount of return to the revenue account or the sales return allowance account once the sale is returned.

Why You Can Trust Finance Strategists

Because if you sell products at your business, you know that not all customers are satisfied. If a customer wants to bring back an item, you need to make sales returns and allowances journal entries. This is usually the case where customers return goods due to they are damaged or defective. In this circumstance, the sales returns and allowances and related accounts are recorded the same as above journal entry.

Would you prefer to work with a financial professional remotely or in-person?

It depends on whether the sale of those goods that were returned were cash sales or credit sales. For a cash sale, debit the Cash account to increase assets and credit the Sales Revenue account to reflect earned income. The accurate recording of sales revenue is paramount in financial accounting, providing insight into the company’s revenue-generating activities. By adhering to the outlined steps and ensuring meticulous documentation, companies can achieve a true and fair view of their financial performance. The sale is recorded by debiting the appropriate asset account (Cash or Accounts Receivable) and crediting the Sales Revenue account. The debit entry increases the asset, reflecting the receipt of cash or the right to receive cash.

What is the accounting treatment of Sales Returns and Allowances?

The second approach is more convenient for companies that experience too many such transactions during the year. Sales revenue is the income statement account, and it is recognized when the control is passed to customers. Sales revenue is increasing in credit and decreasing in debit accounts. The sale return account is created for recording the sale that is returning from the customer.

Sales allowances, on the other hand, are discounts given to customers for keeping such defective or unwanted products instead of returning them. In this article, we cover the accounting for sales returns and allowances; especially the sales returns and allowances journal entry under both periodic and perpetual inventory systems. You can set-up a sales returns and allowances account by opening an appropriate account in your chart of accounts. You can then create journal entries from the beginning that will automatically debit this new account on all future transactions. After assessing the goods, XYZ Co. returned products worth $50,000 as they suffered damages during the delivery. ABC Co. compensated XYZ Co. for the returns by reducing its accounts receivable balance.

How you handle purchase returns depends on your small business return policy. You might offer free returns, charge a restocking fee, accept returns only with a receipt, or not accept returns at all. Or, maybe you decide to compensate customers returning items with store credit.

Companies must also present the sales returns and allowances figures in the financial statements. Usually, these are a part of the net sales calculation in the notes to the financial statements. Companies do not record this transaction as it does not affect the sales or sales return. Sales returns and allowances are refunds or credits given to customers from a purchase. This can occur when a customer is unhappy with a product or service they have received or if they want their money back. On the books of the seller, the customer’s accounts receivable account has a debit balance.

If this entry is not made, Jill’s records might wrongly reflect revenue instead of contra revenue. The format of the sales returns and allowances journal is shown below. When preparing an income statement, the amount in the sales return allowance is deducted from the total sales to calculate the company’s how to amend a tax return actual sales/net sales. Let’s assume that ABC Co sells goods to its customer on 05 January 20X1 for $2,500. In the sales agreement, ABC Co would accept the sales return if the goods are damaged or defective. On 07 January 20X1, the customer finds out that some of the goods received are defective.