Assets and expenses accounts are shown on the debit side, while liabilities, equities, and revenues accounts are down on the credit side. In other words, a trial balance will show all of the balances of accounts after all transactions have been allowed for, including those which have not yet been entered into a general ledger or subsidiary ledgers. It is considered unadjusted because no adjusting entries have been made yet. Most accounting software will let you generate a trial balance at any point in time to allow you to assess the current state of your accounts.

Scoring in the High 90s While Working Full-Time? How Scott Passed His CPA Exams

Enter all account transactions that have occurred during this accounting period into the 2nd column of UBTB. Some mistakes could not be detected, such as failing to record the transactions, removing or eliminating transactions on both sides, and the trial balance. Trial balance how to invoice as a contractor can detect only certain problems like difference amounts recording the same transaction and incorrectly recording debit or credit rules. Another example is that an accountant might post salary expenses on the debit side for both the salary and cash/bank accounts.

Create a Free Account and Ask Any Financial Question

After an unadjusted trial balance has been adjusted with the year-end closing entries, it is considered an adjusted trial balance. The year-end adjusting journal entries include booking prepaid and accrual accounts, recording dividends issued, and the closing entries for the year of the year. These adjusted account balances are then used to create the year-end financial statements. Unadjusted Trial Balance is a direct report extracted by a business from its Double Entry Accounting system. Both the debit and credit columns are calculated at the bottom of a trial balance. As with the accounting equation, these debit and credit totals must always be equal.

What is your current financial priority?

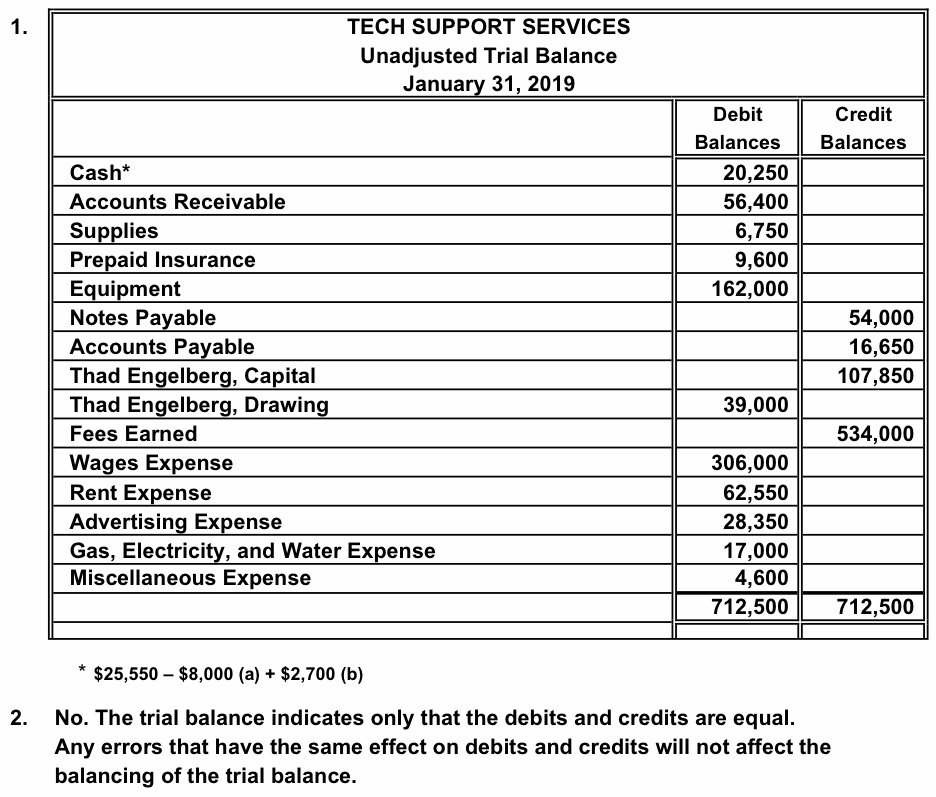

An unadjusted trial balance is prepared to ensure the accounts identify the errors and mistakes that may be present in the records so that the same could be avoided at the later stages. Basically, each one of the account balances is transferred from the ledger accounts to the trial balance. All accounts with debit balances are listed on the left column and all accounts with credit balances are listed on the right column. Once all ledger accounts and their balances are recorded, the debit and credit columns on the trial balance are totaled to see if the figures in each column match each other.

- Bookkeepers, accountants, and small business owners use trial balances to check their accounting for errors.

- However, before every transaction is presented in an organized manner, there is a rough list of transactions accommodated in the unadjusted trial balance.

- This is useful for ensuring that the total of all debits equals the total of all credits.

Ensures all transactions are recorded

The errors have been identified and corrected, but the closing entries still need to be made before this TB can used to create the financial statements. After the closing entries have been made to close the temporary accounts, the report is called the post-closing trial balance. For instance, in our vehicle sale example the bookkeeper could have accidentally debited accounts receivable instead of cash when the vehicle was sold. The debits would still equal the credits, but the individual accounts are incorrect. This type of error can only be found by going through the trial balance sheet account by account.

The main purpose of the unadjusted trial balance is to ensure that the total debits equal the total credits. It’s a preliminary step, and if there are discrepancies, it indicates there might be errors in the journal entries or ledger accounts. In the accounting cycle, an unadjusted trial balance plays a critical role.

If it’s out of balance, something is wrong and the bookkeeper must go through each account to see what got posted or recorded incorrectly. A trial balance sheet is a report that lists the ending balances of each account in the chart of accounts in balance sheet order. Bookkeepers and accountants use this report to consolidate all of the T-accounts into one document and double check that all transactions were recorded in proper journal entry format. However, before every transaction is presented in an organized manner, there is a rough list of transactions accommodated in the unadjusted trial balance. This is the document that lists the accounts and balances before the last adjustments have been made. This unadjusted financial document is prepared based on the general ledger or other sources recording the transactions.

The trial balance is a mathematical proof test to make sure that debits and credits are equal. Keep this process timely by compiling these balances at the end of a reporting period. It could be monthly, quarterly, or annually depending on how often you report finances.

Same as the adjusted trial balance, this statement shows all the closing account balances. It ranks from assets accounts and liabilities accounts, followed by equity, revenues, and expenses accounts. This includes all transactions recorded during a period, such as money received, payments made, expenses incurred, etc. The unadjusted trial balance gives an overall picture of where the business stands financially at any given time. Since the debit and credit columns equal each other totaling a zero balance, we can move in the year-end financial statement preparation process and finish the accounting cycle for the period.

It acts as an auditing tool, while a balance sheet is a formal financial statement. It’s one of the first lines of defense against accounting errors and a pivotal report within double-entry bookkeeping. Let’s look at what a trial balance is, how it works, the various types, and examples. A trial balance is a list of the balances of ledger accounts of a business at a specific point of time usually at the end of a period such as month, quarter or year. One of the main reasons to make this statement is to detect the error that might occur during accounting entry in the accounting ledger. It will include both debit and credit balances, but no adjusting entries have been made yet.