If gold bars have a lower purity degree than this, they can’t be held in an IRA. Complete the type under to Open or Rollover a Lear Capital Precious Metals IRA Account Immediately! Principally, this specific account offers you increased management in regard to your funding. This fashion, you will not one day discover out that your administrator or depository has gone bankrupt or have been pressured to liquidate their property. In other words, gold ira rollover reviews it doesn’t matter what happens with paper currencies, the value of gold will stay constant. For more on gold ira Rollover Reviews take a look at our own website. Investors could use roll-over funds or cash from a 401(k), 403(b), 457(b), or TSP plan. You don’t wish to get engaged with a company that will not show you what you expect from the beginning. Since IRAs usually are not allowed to personal collectibles, that might have resulted in a deemed taxable distribution from the IRA with you then using the money to buy the prohibited EFT shares.

If gold bars have a lower purity degree than this, they can’t be held in an IRA. Complete the type under to Open or Rollover a Lear Capital Precious Metals IRA Account Immediately! Principally, this specific account offers you increased management in regard to your funding. This fashion, you will not one day discover out that your administrator or depository has gone bankrupt or have been pressured to liquidate their property. In other words, gold ira rollover reviews it doesn’t matter what happens with paper currencies, the value of gold will stay constant. For more on gold ira Rollover Reviews take a look at our own website. Investors could use roll-over funds or cash from a 401(k), 403(b), 457(b), or TSP plan. You don’t wish to get engaged with a company that will not show you what you expect from the beginning. Since IRAs usually are not allowed to personal collectibles, that might have resulted in a deemed taxable distribution from the IRA with you then using the money to buy the prohibited EFT shares.

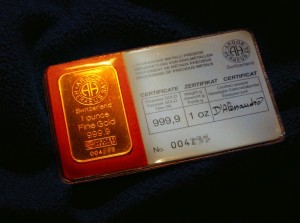

Only six depository vaults in your entire United States of America are authorised to hold the dear contents of these extraordinarily resource-rich retirement accounts. 0.61% return compounded 12 months after yr can make a huge difference in the long term. Pension vs. 401(k): gold ira rollover reviews What’s The Distinction? While this technique will be appealing for many who need to effectively execute a 60-day mortgage of their funds, keep in thoughts that you’ve solely 60 days from the discharge of your 401(okay) funds to complete the transfer. IRAs invested in “paper gold” (e.g., gold ETFs or mining stocks) without investing in bullion or coins will not be gold IRAs. You can speak to your service consultant about which vault location most accurately fits your particular wants. Normally, emergency corpus ought to be liquid in nature and at the identical time shouldn’t be invested in instruments where there’s a risk of lack of capital. Taken altogether, no different investment affords you the same benefits as gold. The authorities at Lear Capital have been helping purchasers maximize their savings with valuable metals like gold and silver for over a decade. A one-ounce American Eagle coin, for example, is barely 91.67% gold; the remaining is silver and copper. There are Gold IRA companies online which you can work with to start your funding journey.

Furthermore, the insurance coverage insurance policies and security measures of the 2 facilities will cement the difficulty of safety. These repositories guarantee the safety of your asset. Real diversification means holding property in numerous different asset classes, including investments in various property similar to real property, agricultural commodities, and valuable metals. At Birch Gold Group, shopping for gold with 401(k) can be boiled down to a few easy steps. So one other good rule of thumb is to purchase gold when things have calmed, at least quickly – the attention of the storm, so to speak. There are several things you’ll want to remember when you’re promoting gold jewelry or other gold objects. There are sturdy protections towards fraud. They’ll help you with any questions you have about starting your Gold or Silver Precious Metal individual retirement account. How Do I Arrange a Self-Directed Account? Though the company’s fundamental focus is on treasured metals, additionally they sometimes work with accounting and estate planning specialists.